Side Hustlers, Gig Workers, Freelancers: Tax Time Savior! Slash Your Bill & Claim FREE Tax Money From the Government

If you are a self employed person and doing side hustles, freelance, or gigs, please listen up because if you don’t you might be leaving money on the table! You grind hard, you slay your side hustles, and you’re building a career on your own terms. But tax season? Not exactly the most exciting part of being self-employed, right? Well, fret no more! This comprehensive guide is jam-packed with everything you need to know about taxes as a self-employed individual in California.

We’ll break down everything from self-employment tax to state income tax, deductions, credits, and even health insurance options. But we’ve got a secret weapon hidden at the very end (hint: it involves getting money back from the government!).

That’s right, we’re talking about the golden ticket of tax credits – the California Self-Employed Tax Credit (SETC). This little gem can help you recover some of that tax money you paid, especially if you took a financial hit during COVID.

So, buckle up, self-employed superstars! This guide is your roadmap to navigating taxes with confidence and maybe even getting some money back in your pocket. Ready to learn how to keep more of your hard-earned cash? Scroll down, read through this entire article (trust us, number 37 is a game-changer!), and then take action! We’ve even included a free service that can help you apply for the SETC and ensure you get all the tax credit money back that is set aside for you and that is owed to you. Let’s get into it!

Has Your Self Employed Side Hustle Business Been Hurt by Covid? Then Claim YOUR Money that is set aside and waiting for

self-employed side hustlers just like you! Watch the video below to Unlock your Funds today and get paid in 14 days (no cost involved)! Click here to get started!

1. Self-Employment Tax

Stay Compliant and Avoid Legal Trouble: Self-Employment Tax consists of Social Security and Medicare taxes for individuals who work for themselves. Paying this tax is crucial for compliance with federal laws and to avoid hefty penalties or legal issues.

Why It Matters: This tax funds your Social Security benefits upon retirement and ensures Medicare coverage. Failure to pay can result in penalties and interest.

Handling it Right: Calculate your tax using Schedule SE (Form 1040). Set aside 15.3% of your net earnings (12.4% for Social Security and 2.9% for Medicare) to cover these taxes.

Act Now: Make quarterly payments using Form 1040-ES. Staying on top of these payments prevents underpayment penalties and ensures you’re covered for future benefits.

Pro Tips: Keep detailed records of income and expenses to accurately calculate net earnings. Set aside a portion of your income regularly to manage your tax obligations effectively.

Get the full Self-Employment Tax Guide for Californian Side Hustlers & Gig Workers with Pro Tax Hacks right here!

2. California State Income Tax

Prevent Financial Penalties: California state income tax is imposed on your net income. Compliance is mandatory to avoid severe financial penalties and possible legal action.

Importance: The state income tax funds various public services and infrastructure projects in California.

Handle with Care: Report your income using Form 540 (California Resident Income Tax Return) along with Schedule C or Schedule C-EZ for business profits or losses.

Deadline Alert: Estimated taxes are due quarterly, and the final reconciliation is done when you file your annual tax return.

Pro Tips: Keep thorough records of all business-related expenses to maximize deductions and minimize taxable income. Regularly review your earnings and expenses to adjust your estimated payments if necessary.

3. Estimated Taxes

Avoid Underpayment Penalties: Estimated tax payments help cover self-employment tax and income tax, reducing the risk of underpayment penalties.

Crucial Compliance: Making these payments ensures you meet IRS and California Franchise Tax Board requirements and avoid additional charges for late payments.

How to Handle: Calculate estimated taxes using Form 1040-ES (federal) and Form 540-ES (California), based on your expected income, deductions, and credits. Use last year’s tax return as a guide.

Key Dates: Payments are due on April 15, June 15, September 15, and January 15 of the following year.

Pro Tips: Monitor your earnings closely and adjust your estimated payments if your income changes significantly during the year.

4. Self-Employment Health Insurance Deduction

Maximize Tax Savings: Deduct premiums for medical, dental, and qualified long-term care insurance for yourself, your spouse, and your dependents to lower your taxable income.

Significance: This deduction can significantly reduce your tax liability, making health insurance more affordable.

Process: Claim this deduction on Form 1040, Line 16. Keep detailed records of your premium payments.

Annual Action: Claim it when you file your annual tax return.

Pro Tips: Ensure your health insurance plan qualifies for this deduction. Maintain thorough documentation of all premium payments.

5. Qualified Business Income Deduction (QBI)

Cut Your Tax Bill: Eligible self-employed individuals can deduct up to 20% of their qualified business income, offering substantial tax savings.

Why It’s Important: This deduction reduces your taxable income, potentially lowering your overall tax bill significantly.

Steps to Take: Calculate the deduction using Form 8995 or Form 8995-A and report it on Form 1040.

Tax Filing Time: Claim it when you file your annual tax return.

Pro Tips: Check if your business income qualifies and understand any limitations or phase-outs. Consult IRS guidelines or a tax professional for detailed advice.

6. Retirement Plan Contributions

Secure Your Future and Save on Taxes: Contributing to retirement plans like SEP IRA, Solo 401(k), or SIMPLE IRA offers tax deductions and secures your financial future.

Long-Term Benefits: Contributions are tax-deductible, lowering your taxable income and helping you build a retirement nest egg.

Action Plan: Set up a retirement plan with a financial institution and make contributions up to the allowable limits.

Key Timing: Contributions can be made up to the tax filing deadline, including extensions.

Pro Tips: Consult a financial advisor to choose the best plan for your situation. Maximize contributions to benefit from tax deferral and compound growth.

7. Home Office Deduction

Leverage Your Home Office: Deduct expenses related to the portion of your home used exclusively for business, reducing your taxable income.

Significance: This deduction can lead to substantial tax savings if you use part of your home for business purposes.

Steps to Follow: Calculate the deduction using Form 8829 and report it on Schedule C.

Annual Reminder: Claim it when you file your annual tax return.

Pro Tips: Ensure the space is used regularly and exclusively for business. Keep detailed records of home expenses, including mortgage interest, utilities, and repairs.

8. Business Expenses

Cut Costs and Boost Deductions: Deduct a wide range of business expenses such as office supplies, equipment, travel, and marketing to lower your taxable income.

Why It Matters: Claiming all eligible expenses reduces your taxable income, saving you money on taxes.

Action Steps: Report expenses on Schedule C or Schedule C-EZ.

Tax Time: Claim them when you file your annual tax return.

Pro Tips: Maintain meticulous records and receipts for all business-related expenses. Separate personal and business expenses to avoid complications.

9. Health Savings Account (HSA)

Tax-Advantaged Savings for Health: An HSA offers tax-deductible contributions and tax-free withdrawals for medical expenses, providing significant tax benefits.

Importance: Contributions reduce your taxable income, and the account can be used to pay for qualified medical expenses tax-free.

Steps to Open: Open an HSA with a financial institution and make contributions up to the annual limit.

Contribution Deadline: Contributions can be made up to the tax filing deadline.

Pro Tips: Ensure your health plan qualifies as an HDHP. Keep records of medical expenses paid from the HSA.

10. Child and Dependent Care Credit

Reduce Your Tax Bill: A tax credit for a portion of expenses related to the care of children or dependents enables you to work and can significantly lower your tax liability.

Why It’s Beneficial: This credit directly reduces your tax bill and can increase your refund.

How to Claim: Use Form 2441 and report it on Form 1040.

Annual Task: Claim it when you file your annual tax return.

Pro Tips: Keep detailed records of care expenses and ensure the care provider’s information is accurate on your tax forms.

11. Educational Expenses

Invest in Your Skills and Save: Deduct expenses for courses or training related to maintaining or improving skills required in your business, reducing your taxable income.

Why It’s Important: Enhancing your skills can lead to business growth, and deducting these expenses lowers your tax liability.

Claim Process: Report them on Schedule C.

Annual Deduction: Claim them when you file your annual tax return.

Pro Tips: Ensure the education expenses are directly related to your business. Keep receipts and documentation of the courses or training attended.

12. Internet and Phone Bills

Claim Business Use: Deduct the portion of your internet and phone bills used for business purposes to reduce your taxable income.

Significance: These deductions lower your overall tax liability by recognizing essential business expenses.

How to Deduct: Calculate the business-use percentage and report it on Schedule C.

Annual Filing: Claim it when you file your annual tax return.

Pro Tips: Maintain records of your internet and phone bills and document the business use portion accurately.

13. Depreciation

Spread Out Costs: Deduct the cost of property and equipment over its useful life, reducing your taxable income over time.

Why It Matters: Depreciation allows you to recover the cost of significant business investments gradually.

Steps to Follow: Use Form 4562 to calculate depreciation and report it on Schedule C.

Annual Filing: Claim it when you file your annual tax return.

Pro Tips: Keep detailed records of asset purchases and depreciation schedules. Consult IRS guidelines for the appropriate depreciation methods.

14. Business Interest Expenses

Deduct Loan Interest: Claim a deduction for interest paid on business loans and credit lines, reducing your taxable income.

Significance: Deducting interest expenses lowers your overall tax liability, recognizing the cost of financing your business.

How to Claim: Report interest expenses on Schedule C.

Annual Task: Claim it when you file your annual tax return.

Pro Tips: Maintain records of loan agreements and interest payments. Ensure the loans are used solely for business purposes.

15. Startup Costs

Offset Initial Investments: Deduct up to $5,000 in startup costs in the first year of business, reducing your taxable income right from the start.

Why It’s Important: This deduction helps manage the financial burden of starting a new business.

Claim Process: Report startup costs on your initial tax return using Schedule C.

First-Year Task: Claim it in the first year of business operations.

Pro Tips: Keep detailed records of all startup expenses. Consult IRS guidelines to determine which costs qualify as startup expenses.

16. Self-Employed Tax Credit (California Specific)

Direct Tax Reduction: Designed to assist self-employed individuals, the California Self-Employed Tax Credit helps offset the costs of maintaining a business in the state.

Why It’s Beneficial: This credit can directly reduce your California state tax liability, providing financial relief.

How to Claim: Details on this credit can be found through the California Franchise Tax Board. Typically, you’ll need to provide proof of self-employment income and expenses.

Annual Task: Claim it when you file your California state income tax return using Form 540.

Pro Tips: Stay updated with California tax regulations to ensure you’re taking advantage of all available credits and deductions. Keep detailed records of all business-related expenses and income.

17. California EITC (Earned Income Tax Credit)

Boost Your Income: The California Earned Income Tax Credit (CalEITC) is a refundable credit for low-income earners, including self-employed individuals.

Importance: This credit can increase your refund or reduce the taxes you owe, offering significant financial support.

Eligibility and Claiming: Eligibility depends on your income and number of dependents. File your state tax return and include Form 3514 to claim CalEITC.

Annual Filing: Claim it when you file your annual California state tax return.

Pro Tips: Check the income thresholds and eligibility criteria annually as they can change. Ensure all your income is accurately reported to maximize your credit.

18. Sales and Use Tax

Stay Compliant with California Law: If you sell goods or services in California, you may be required to collect and remit sales tax. Use tax applies to goods purchased out-of-state but used in California.

Why It Matters: Compliance with sales and use tax laws is mandatory to avoid penalties and interest.

How to Handle: Register for a seller’s permit with the California Department of Tax and Fee Administration (CDTFA). Collect sales tax at the point of sale and file regular returns.

Regular Reporting: Sales tax returns are typically filed quarterly or annually, depending on your sales volume.

Pro Tips: Keep detailed sales records and understand which products and services are taxable. Regularly review CDTFA guidelines for updates on tax rates and exemptions.

19. California R&D Tax Credit

Encourage Innovation: The California Research and Development (R&D) Tax Credit incentivizes businesses to invest in R&D activities within the state.

Significance: This credit can reduce your state tax liability, making it more affordable to develop new products or processes.

Claim Process: Calculate your credit using Form 3523 and include it with your California state tax return.

Annual Filing: Claim it when you file your annual California state tax return.

Pro Tips: Maintain detailed documentation of all R&D activities and expenses. Consult a tax professional to ensure you’re maximizing your credit.

20. Vehicle Expense Deduction

Deduct Business-Related Travel: If you use your vehicle for business purposes, you can deduct related expenses such as gas, maintenance, and depreciation.

Why It’s Important: These deductions can significantly reduce your taxable income.

How to Deduct: Choose between the standard mileage rate or actual expense method. Report the deduction on Schedule C.

Annual Filing: Claim it when you file your annual tax return.

Pro Tips: Keep a detailed mileage log and all receipts for vehicle-related expenses. Choose the deduction method that offers the greatest tax benefit.

21. California Homestead Exemption

Protect Your Home: The California Homestead Exemption protects a portion of your home’s value from creditors in the event of bankruptcy.

Why It’s Important: This exemption provides financial security by safeguarding your primary residence.

How to Apply: File the appropriate forms with your county recorder’s office to claim the homestead exemption.

Annual Review: Review and update your exemption status if there are changes in your property ownership.

Pro Tips: Understand the exemption limits and ensure your home qualifies. Consult with a legal advisor if you have questions about the process.

22. California Disability Insurance (SDI) Tax

Ensure Coverage: California’s State Disability Insurance (SDI) program provides short-term disability benefits to eligible workers, including self-employed individuals who opt in.

Importance: Participation ensures financial support if you are unable to work due to a disability or family leave.

How to Opt In: Self-employed individuals can voluntarily enroll in the SDI program through the Employment Development Department (EDD).

Regular Payments: Contributions are made through quarterly payments based on your income.

Pro Tips: Evaluate the benefits of SDI coverage and maintain accurate records of your contributions. Understand the eligibility criteria and benefits offered by the program.

Has Your Self Employed Side Hustle Business Been Hurt by Covid? Then Claim YOUR Money that is set aside and waiting for

self-employed side hustlers just like you! Click Here to Unlock your Funds today and get paid in 14 days (no cost involved)!

23. California Paid Family Leave (PFL) Tax

Support During Family Leave: California’s Paid Family Leave (PFL) program provides benefits to individuals who need to take time off for family-related reasons, such as caring for a sick family member or bonding with a new child.

Why It’s Important: Participation in the PFL program ensures financial support during qualifying family leave periods.

How to Participate: Self-employed individuals can voluntarily enroll in the PFL program through the Employment Development Department (EDD).

Contribution Process: Similar to SDI, contributions are made quarterly based on your income.

Pro Tips: Understand the benefits and eligibility criteria for PFL. Keep detailed records of your contributions and qualifying leave periods.

24. California Alternative Minimum Tax (AMT)

Be Aware of Additional Tax: California has an alternative minimum tax (AMT) that may apply to certain high-income earners, including self-employed individuals.

Why It’s Important: The AMT ensures that high-income earners pay a minimum amount of tax, regardless of deductions and credits.

How to Calculate: Use California Form 540 Schedule P to determine if you owe AMT.

Annual Filing: Calculate and pay AMT when you file your annual California state tax return.

Pro Tips: Review your tax situation annually to see if AMT applies. Consult a tax professional to navigate the complexities of AMT calculations.

25. Local Business Taxes

Comply with Local Regulations: Depending on your location in California, you may be subject to additional local business taxes or fees.

Why It’s Important: Compliance with local tax regulations is mandatory and supports local infrastructure and services.

How to Handle: Check with your city or county tax office for specific requirements and deadlines. Common taxes include business license fees and gross receipts taxes.

Regular Payments: Local taxes may be due quarterly or annually, depending on local regulations.

Pro Tips: Stay informed about local tax requirements and deadlines. Keep detailed records of all local tax payments and correspondence with tax authorities.

26. California Green Energy Credits

Promote Sustainable Practices: California offers various tax credits and incentives for businesses that invest in renewable energy and sustainable practices.

Significance: These credits can reduce your state tax liability and support environmental initiatives.

How to Claim: Research available credits through the California Energy Commission and the California Franchise Tax Board. Common credits include those for solar energy systems and energy-efficient upgrades.

Annual Filing: Claim applicable credits when you file your annual California state tax return.

Pro Tips: Stay updated on available green energy incentives. Maintain detailed records of qualifying investments and expenses. Consult with a tax professional to maximize your benefits.

By understanding and managing these taxes and credits, self-employed individuals in California can optimize their financial situation, stay compliant with state and federal regulations, and avoid potential penalties.

27. California New Employment Credit

Encourage Job Creation: The New Employment Credit (NEC) offers tax benefits to businesses that hire full-time employees in designated areas and who meet specific criteria.

Why It’s Important: This credit incentivizes job creation and can significantly reduce your state tax liability.

How to Claim: Verify employee eligibility and calculate the credit using Form 3554. Submit the form with your California state tax return.

Annual Filing: Claim the credit when you file your annual California state tax return.

Pro Tips: Ensure that employees meet the eligibility requirements and that your business is located in a designated geographic area. Maintain detailed records of hiring and employment practices.

28. California Competes Tax Credit

Expand Your Business: The California Competes Tax Credit is available to businesses that plan to grow and add jobs in California.

Significance: This credit can provide substantial financial support for business expansion efforts.

How to Apply: Applications are submitted through the California Governor’s Office of Business and Economic Development (GO-Biz).

Application Periods: Check GO-Biz for application periods and deadlines. Typically, there are several application rounds each year.

Pro Tips: Prepare a strong business plan demonstrating job creation and investment in California. Consult with GO-Biz for application guidance and criteria.

29. Small Business Health Care Tax Credit

Support for Providing Health Insurance: Self-employed individuals who provide health insurance to their employees can benefit from the Small Business Health Care Tax Credit.

Why It’s Beneficial: This credit helps offset the costs of providing health insurance, making it more affordable for small business owners.

How to Claim: Use Form 8941 to calculate the credit and include it with your federal tax return. Note that this federal credit can indirectly affect your state tax liability.

Annual Filing: Claim it when you file your annual federal and California state tax returns.

Pro Tips: Ensure you meet the eligibility criteria, including the number of employees and average wages. Maintain records of health insurance premiums paid.

30. Work Opportunity Tax Credit (WOTC)

Hire and Save: The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to employers who hire individuals from certain target groups that face employment barriers.

Importance: This credit reduces your federal tax liability, which can indirectly benefit your overall financial situation.

How to Claim: Complete Form 8850 and submit it to the appropriate state workforce agency. Once certified, claim the credit using Form 5884 on your federal tax return.

Annual Filing: Claim it when you file your annual federal tax return and account for any effects on your California state tax return.

Pro Tips: Check the eligibility of new hires against the target groups. Submit certification requests promptly after hiring.

31. Disabled Access Credit

Improve Accessibility: This federal tax credit supports small businesses that make their facilities accessible to individuals with disabilities.

Why It’s Important: Improving accessibility not only benefits your business but also provides a tax credit to offset costs.

How to Claim: Use Form 8826 to calculate and claim the credit on your federal tax return.

Annual Filing: Claim it when you file your annual federal tax return and consider its implications for your California state tax return.

Pro Tips: Maintain detailed records of expenditures related to improving accessibility. Ensure that modifications meet ADA standards.

32. California Motion Picture and Television Production Credit

Support Local Productions: This credit is designed for businesses involved in the production of films, TV shows, and other motion pictures in California.

Significance: This credit can significantly reduce your tax liability and support the local entertainment industry.

How to Apply: Applications must be submitted to the California Film Commission. Once approved, claim the credit using Form 3541.

Application and Filing Periods: Check with the California Film Commission for application deadlines and filing requirements.

Pro Tips: Prepare comprehensive production budgets and documentation. Ensure all expenditures are eligible for the credit.

33. Research & Development (R&D) Credit

Foster Innovation: This credit rewards businesses that conduct research and development activities in California.

Why It’s Important: Encourages innovation and can substantially lower your state tax liability.

How to Claim: Calculate the credit using Form 3523 and include it with your California state tax return.

Annual Filing: Claim it when you file your annual California state tax return.

Pro Tips: Keep meticulous records of R&D activities and expenses. Consult a tax professional to maximize the credit.

34. California Clean Vehicle Rebate Project (CVRP)

Promote Clean Transportation: Self-employed individuals who purchase or lease eligible zero-emission vehicles can receive rebates.

Significance: Reduces the cost of clean vehicles and supports California’s environmental goals.

How to Apply: Submit an application through the Clean Vehicle Rebate Project website after purchasing or leasing an eligible vehicle.

Application Period: Apply soon after the vehicle purchase or lease to ensure eligibility.

Pro Tips: Check the list of eligible vehicles and rebate amounts. Ensure timely submission of all required documents.

35. California Manufacturing and Research & Development Equipment Exemption

Reduce Equipment Costs: This exemption allows businesses to purchase manufacturing and R&D equipment without paying sales tax.

Why It’s Beneficial: Reduces upfront costs and supports business growth and innovation.

How to Claim: Complete and submit a partial exemption certificate to your vendor at the time of purchase.

Annual Review: Review your equipment purchases annually to ensure compliance and maximize savings.

Pro Tips: Keep detailed records of all equipment purchases and use. Consult the CDTFA for guidance on eligible items.

36. California Solar Initiative (CSI) Tax Credits

Invest in Solar Energy: Businesses that install solar energy systems can receive tax credits to offset installation costs.

Importance: Encourages renewable energy use and provides significant financial incentives.

How to Claim: Research available solar incentives through the California Energy Commission and the California Franchise Tax Board. Submit appropriate forms with your tax return.

Application and Filing: Apply for incentives soon after installation and claim credits on your annual California state tax return.

Pro Tips: Ensure your solar installation meets eligibility criteria. Maintain documentation of installation and costs.

By leveraging these specific taxes and credits, self-employed individuals in California can optimize their financial situation, reduce tax liabilities, and ensure compliance with state regulations. This comprehensive guide serves as a valuable resource for understanding and managing the various financial obligations and opportunities available to self-employed Californians.

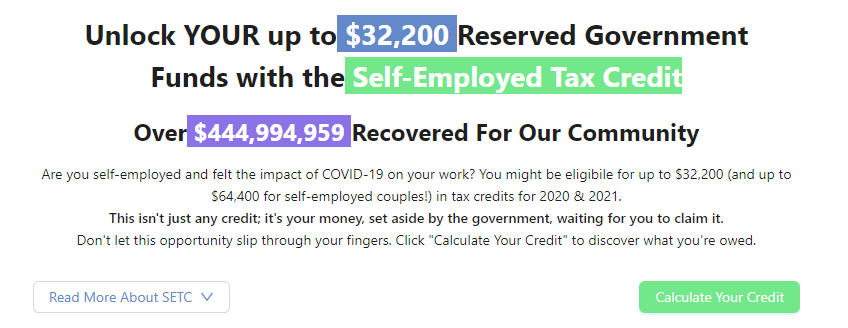

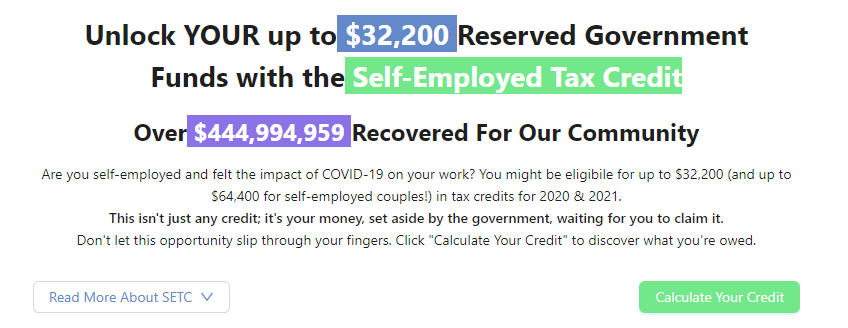

37. Self-Employed Tax Credit (SETC) – California

Reduce Your Tax Burden: The Self-Employed Tax Credit (SETC) in California is designed to assist self-employed individuals by providing a credit that can reduce state tax liabilities.

Why It’s Beneficial: This credit directly reduces the amount of state income tax you owe, offering significant financial relief for self-employed individuals who are often responsible for both employer and employee portions of Social Security and Medicare taxes.

Eligibility: To qualify for the SETC, you must be self-employed and file a Schedule C (Form 1040) or Schedule C-EZ, detailing your business income and expenses. The credit is available to those who meet certain income thresholds and other criteria set by the California Franchise Tax Board.

How to Claim:

- Calculate Your Income and Expenses: Use Schedule C or Schedule C-EZ to report your net profit or loss from your business.

- Determine Credit Amount: The exact credit amount can be calculated based on the percentage of your net income that qualifies under the state guidelines.

- Submit the Form: Claim the credit when you file your California state income tax return using Form 540 and any supplementary forms required by the Franchise Tax Board.

- Let the Self Employed Tax Credit Pros handle the whole process for you and free of charge so you can focus on your business!

Annual Filing: Claim the SETC when you file your annual California state tax return. Be sure to include all necessary documentation and forms to substantiate your claim.

Pro Tips:

- Keep Accurate Records: Maintain thorough records of your business income, expenses, and any other pertinent financial documents to ensure accurate reporting and to substantiate your claim.

- Consult a Tax Professional: If you are unsure about your eligibility or how to properly claim the SETC, consulting with a tax professional can help you maximize your benefits and ensure compliance with state regulations.

- Stay Updated: Tax laws and credit criteria can change. Regularly check for updates from the California Franchise Tax Board to ensure you are aware of any changes that might affect your eligibility for the credit.

- Don’t make the costly mistakes of doing this yourself, let the pros handle everything for you!

Additional Considerations:

Given the specific nature of tax credits and incentives, it’s crucial for self-employed individuals in California to review each opportunity carefully. Ensure eligibility criteria are met, and consult with a tax professional to optimize your tax strategy and maximize available benefits.

For further guidance tailored to your specific situation, always consider consulting with a qualified tax advisor or a professional service that can do this for you free of charge because they can provide personalized advice based on current tax laws and regulations in California.

Real People, Real Results: How Self-Employed Individuals Like You Are Winning with the Self Employed Tax Credit (SETC)

-

Sarah, the Freelancer: Sarah, a freelance writer, saw her income dip significantly in 2020 due to project cancellations. Worried about taxes, she discovered the SETC and a free service to help with the application. Thanks to the credit, she received a substantial tax refund, allowing her to catch up on bills and invest back into her business.

-

David, the Rideshare Driver: David, a rideshare driver, experienced reduced work hours due to COVID restrictions. The SETC, claimed with the help of a free service, significantly reduced his tax liability and put extra money in his pocket. He used the refund to pay for car maintenance and save towards a down payment on his own vehicle.

-

Maria, the Etsy Shop Owner: Maria’s Etsy shop sales took a hit during the pandemic. The SETC, claimed through a free service, helped offset her self-employment taxes and provided her with a much-needed financial boost. She used a professional service that helped her get the tax refund she deserved. She used her self employed tax credit to restock her inventory and expand her product line.

These are just a few examples of how the SETC has helped self-employed individuals during challenging times. Remember, the specific amount you receive depends on your income and circumstances. However, with this free service taking care of the entire application process for you, there’s no reason not to explore this potential tax benefit and claim the money you deserve.

Conclusion: Conquer Tax Season and Claim Your Cash Back!

Congratulations, self-employed superstars! You’ve reached the end of this comprehensive tax guide. Now you’re armed with the knowledge to tackle tax season with confidence. Remember, staying organized with your finances throughout the year makes tax filing a breeze.

Don’t forget the game-changer at number 37: the California Self-Employed Tax Credit (SETC). This credit can significantly reduce your tax burden, especially if you faced financial challenges during COVID. Here’s how to claim it:

- Free SETC Application Service: We’ve partnered with a reputable service that can handle the entire SETC application process for you, absolutely free! Simply, “click here” or “visit their website” to get started and ensure you claim every credit you deserve.

Additional Resources

Remember: This guide serves as a starting point. Tax laws can be complex, so don’t hesitate to consult with a tax professional for personalized advice, especially if you have a unique tax situation. But with the information you’ve gained here, you’re well on your way to maximizing your deductions, minimizing your tax bill, and potentially getting some money back from the government.

So go forth, conquer tax season with confidence!

Disclaimer: This article provides general information about taxes and credits for self-employed individuals in California. It is not intended to be a substitute for professional tax advice. Tax laws and regulations can be complex and change frequently. For personalized advice on your specific situation, consult with a qualified tax professional who can account for your unique circumstances and current tax laws.