Employee Retention Credit Worksheet, Employee Retention Credit Form 941, 7200, 1120 With Examples & Employee Retention Tools To Fill Out ERC Credit Form In A Simple Way

Simple ERC Guide: Employee Retention Credit Worksheet To Maximize Results, All Important Forms, Best Employee Retention Tools That Help Filling Out ERC Form 941, 7200, 1120 & Tips

Overview Of ERC

According to a recent article published by Forbes, some of the most prevalent remarks that job searchers are making during this period, which has been termed “the Great Resignation,” include the following phrases:

“I don’t believe my contributions are appreciated at this company.”

“Several of my contemporaries have left the organization, and they have been presented with amazing opportunities.”

If I quit the company tomorrow, I highly doubt that anybody would even notice my absence.

“Rather of promoting from within, the corporation continues to bring in new employees from outside the organization.”

So, what’s the common thread that runs across all of these feelings? Why do people decide to quit their jobs? An absence of acknowledgment for employee contributions.

Recognizing employees for their contributions may seem to be a straightforward solution and in order to carry it out effectively, both a system and ongoing efforts are required. However, do you believe that it is really worth the additional effort?

Without a doubt, particularly taking into account the fact that between 50 and 75 percent of staff turnover may be prevented.

Other factors, such as emotional safety, team camaraderie, and mental wellness, bear equal weight in the equation for employee retention. Things like pay, bonuses, and work-life balance are important, but they aren’t the only factors that count.

We’ve compiled a bunch of resources for you that will help you get more productive when it comes to filling out your ERC paperwork.

Let’s get started with the helpful Employee Retention Credit Worksheet first, then have a look at the different forms that play an important role with ERC, then we take a look at the best tools that help with the ERC process, and we finish off with some killer tips that help increase your business reputation in order to make your employees stick and your company thrive way beyond 2022.

WORKSHEETS:

Employee Retention Credit Worksheet That Helps Explain ERC to Small and Middle Sized Businesses

Click here to download your Employee Retention Credit Worksheet PDF

During the course of the previous year, a number of rules and regulations that are favorable to commercial enterprises and charitable organizations were passed. The CARES Act, the Coronavirus Assistance Package, and the most recent American Rescue Plan Act (ARPA) each provide employers special relief in the form of the Paycheck Protection Plan (PPP) and the Employee Retention Credit.

These measures were passed in response to the outbreak of the coronavirus (ERC). During this time of enormous unpredictability, these programs may be a savior for your company or charitable organization and help retain employees in their jobs. On the other hand, they may be frightening and demand computations and reporting that even the most seasoned experts could find difficult to understand.

Professional ERC Advisors from Bottom Line Concepts are available to make this process simpler and FREE. They want you to be able to concentrate on running your company and achieving your goals without being distracted by the complexities of complying with various tax laws and regulations.

Most recently, ARPA established new requirements linked to the employee retention credit, which may bring financial advantages to your company as well as the nonprofit organization that you work for. To be more specific, the Employee Retention Credit (ERC) has had its expiration date pushed back to December 31, 2021 from June 30, 2021.

Throughout this prolonged period of time, the ARPA will maintain the ERC rate of credit at the previous level of 70%. Additionally, it maintains the possibility of earning up to $10,000 in eligible compensation throughout any given calendar quarter.

When taking into consideration both the extension of the Consolidated Appropriations Act and the extension of the ARPA, this indicates that a company has the potential to have up to $40,000 in qualifying wages for each employee until the year 2021.

Producing many statistics as well as relevant documents is necessary in order to calculate your ERC. We have devised a spreadsheet for you to use in order to facilitate the information collection process, which should make the procedure a little bit simpler for you.

You will need to gather the following data in order to complete the Employee Retention Credit Worksheet and become eligible for the ERC:

Information Regarding Your Workforce

Information Regarding Applications for PPP1 and PPP2

Information Regarding Payroll Providers

941s for each quarter

Detailed Reports on the Payroll Process (By Quarter)

For modified returns that are claiming ERC, drafts of form 941x are required.

In addition, you will be required to provide financial data about the gross revenues generated by your company or nonprofit organization between the dates of April 1, 2020 and December 31, 2021.

Gross Revenue of an Entity Operating for Profit

Total Sales (Less Returns and Allowances)

Additionally: income from investments and interest

Dividends

Rents

Annuities

Royalties

Reduced by the Amount of the Adjusted Basis in the Assets Sold

NONPROFIT Entity’s Annual Total Revenues

Total Revenue (Less Returns and Allowances)

Plus: income from investments plus income from other sources

Interest

Rent

Royalties

Gifts

Grants

Annuities

Contributions

Member Dues

To qualify for the ERC in 2020, your company or nonprofit organization will need to demonstrate a substantial drop in gross revenues starting on April 1, 2020 and continuing through January 1, 2021. Your business or nonprofit organization will be eligible for a credit during the quarter in which it returns to revenue levels of 80 percent or more. The following illustration shows that the aforementioned business is eligible for ERC benefits until the 31st of December, 2020.

To qualify for the ERC in 2020, your company or nonprofit organization will need to demonstrate a substantial drop in gross revenues starting on April 1, 2020 and continuing through October 1, 2020. Your business or nonprofit organization will be eligible for a credit during the quarter in which it returns to revenue levels of 80 percent or more. The following illustration shows that the firm in question remains eligible for ERC benefits until September 30, 2020.

To get all the updated ERC process done for you without worrying about the dates, the requirements, qualifications, calculations, deadline, etc click here and you will get instant free help with the ERC process for 2022 & beyond.

The certified professional ERC advisors at Bottom Line Concepts have knowledgeable Employee Retention Credit Refund experts on hand and are ready to assist you throughout this whole process. Regarding the PPP and the ERC, they are prepared to answer any and all questions you may have. Click here if you have at least 5 W2 employees and if you have not yet received your ERC refund and get Free help ASAP!

2021 Form 941 Worksheet PDF

Here is a Worksheet in Pdf format for preparing or amending the 941-X forms in order to claim your company’s Employee Retention Credit and FFCRA credit related to the COVID relief.

Download the 2021 FROM 941 Worksheets right here!

941-x Form – 941-x Instructions – IRS Forms And Publications

IRS 2021-49 ERC Notice Released on Aug. 4th 2021

IRS Guidance on Revenue Procedure for examining gross profits of the company

Department of Labor FFCRA Guide (ERC Worksheet Guide)

The ERC specialists at Bottom Line Concepts are providing the whole ERC process for Free to determine how much your company will be refunded. They do everything from calculation to paying out your company the ERC refund. To see if your company qualifies, please fill out this form.

FORMS:

Employee Retention Credit Forms Explained With Examples

What Exactly Is The 941 Form 2022

The 941 IRS Form for Employee Retention Credit is a form that is filed with the IRS to claim a credit for retaining qualified employees. The form is used by employers to claim a credit of up to 25% of taxable wages paid during the year when they have at least one employee who was working for them at some point during the year. The employer must have paid at least $1,000 in wages to qualify for the credit and the employee must have worked on average 20 hours per week or more. during the year. The credit is capped at $25,000 for a single employer and $50,000 for multiple employers.

Every three months, employers are required to report the amount of income taxes, Social Security taxes, and Medicare taxes that were withheld from their workers’ paychecks using Form 941. In addition, you are required to provide the percentage of both Social Security and Medicare taxes that were covered by the employer during each quarter.

These forms must be submitted no later than midnight on the last day of the month that follows the conclusion of a quarter. To provide one example, the deadline for submitting your form for the first quarter of the year is the 30th of April. The deadline for submitting your form for the second quarter is the 31st of July. You have till October 31st to turn in your form for the third quarter of the year. Last but not least, the deadline for submitting your form for the fourth quarter is the 31st of January. If the due date is on a day that is not a business day, such as a weekend or a holiday, the due date will be moved to the next day that is a business day.

You may be subject to fines from the Internal Revenue Service (IRS) if you either do not submit your Forms 941 or file them late. You might, for instance, be subject to a penalty equal to five percent (5%) of the tax that is owed along with each Form 941 for each month or partial month that the form is late. The maximum amount of this penalty is twenty-five percent (25 percent ). You can be subject to a second penalty if you make payments late or if you don’t pay the required amount. Depending on how much later than required you filed your form, this penalty might be anywhere from two percent (2%) to fifteen percent (15%) of the underpayment.

Fillable 941 Form

The 941 form is a tax form that is used to report income and expenses for a business. It is also known as the Employer’s Quarterly Federal Tax Return. The 941 form is filed by employers who have employees and are required to withhold taxes from their employees’ paychecks.

The 941 form can be filled out on paper or electronically. If you choose to fill it out on paper, you will need to print the form, fill in the blanks, and mail it in with your payment. If you choose to fill it out electronically, you will need to file your return through an online service provider or software program that can generate the 941 form for you. Just like this one!

Form 941 for 2022

You can get the latest fillable form 941 right here

941 Form 2021 Pdf

The 941 Form 2021 Pdf is a form that is used by employers to report their employees’ wages and taxes. The form is filed with the IRS on a quarterly basis. The 941 Form 2021 Pdf is also known as the Employer’s Quarterly Federal Tax Return. It is used to report wages, social security taxes, Medicare taxes, and withheld income tax for employees. Employers filing the form must give it to their employees by January 31st of the following year. If an employer does not file a 941 Form, they must pay back any money that is withheld for taxes.

941 Instructions 2022

The 941 instructions are a set of instructions that the IRS provides to help taxpayers calculate their taxes. The instructions are updated every year and they provide guidance on how to calculate the taxes for different types of income. You can find all the instructions right here.

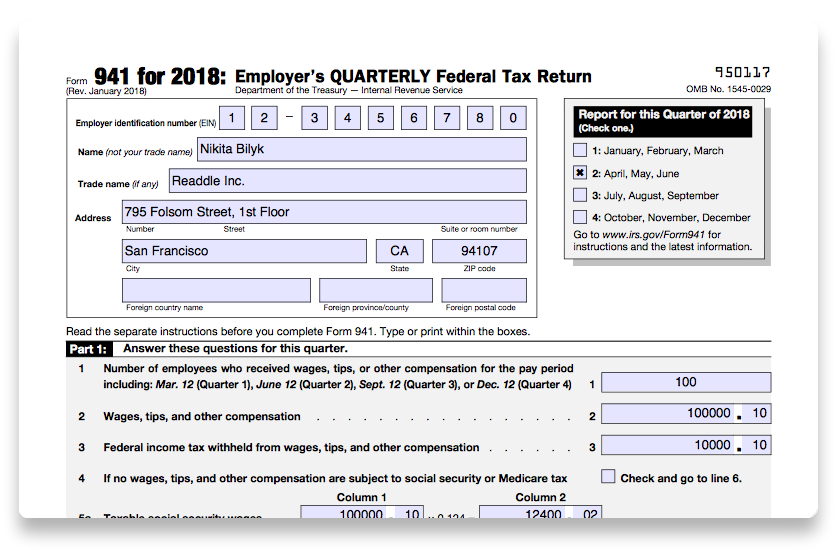

941 Form Example

This is an example of a fillable Form 941 that you may refer to if you need to.

This is what a Form 941 looks like when it is completed correctly:

How to Complete Form 941 Instructions

Step 1

The first step is to decide if you want to use the 941 fillable form here or the traditional form from the IRS here. Next determine the total pay and the number of employees for the period being reported.

To begin, on line 1, you will need to indicate the total number of workers who were paid during the period covered by this return. At line 2, you will need to enter the entire amount of pay that was given out to each employee during the quarter.

Step 2

Proceed to Step 2, which deals with the Amounts Deducted from the Pay of Employees for the Period

Second, on line 3, you are required to state the aggregate amount of income tax that was deducted from each employee’s paycheck during the quarter.

Step 3

Social Security and Medicare Wages That Are Subject to Taxation for the Period

In the third step of the process, you must fill out line 5a with the entire amount of your taxable salary that is subject to Social Security taxes. This number has to be multiplied by.124, and the result needs to be entered in Column 2.

If your workers get tips, you need to go through this procedure again to determine how many tips they received, and then enter those numbers on line 5b. In column 1 of line 5c of your return, you will need to enter the entire amount of pay that is taxable under Medicare, and then multiply that amount by.029.

Put the answer in Column 2 when you’re done. The total of all of the sums that are listed on lines 5a, 5b, and 5c should be entered on line 5d.

Step 4

Calculating the Total Wages Subject to Social Security and Medicare, the Fourth Step

The payment to Social Security and Medicare comes through the Federal Insurance Contributions Act levy, which is sometimes known as the FICA tax. This tax is determined for each employee based on a percentage of their annual wage. In 2019, the Social Security tax is equivalent to 12.4% of the first $132,900 in earnings before reaching the cap of $132,900. The employee is responsible for paying a sum equivalent to 2.9 percent of their total wage as a Medicare levy.

When it comes to workers, the employer is responsible for paying half of both taxes, while the employee is responsible for paying the other half. Since you do not have an employer, you are responsible for paying the whole amount of both taxes if you are self-employed. These taxes are also referred to as “self-employment taxes.” On the other hand, persons who are self-employed are eligible to receive a deduction equal to half of this amount of taxes when they submit their tax returns.

Step 5

Adjustments for Sick Pay, Tips, Group-Life Insurance, and Other Matters are Made in the Fifth Step

You also have the ability to make specific modifications to the way certain payments or perks are handled. For instance, you may deduct from your totals any Social Security or Medicare taxes that were withheld from sick pay and paid for by other parties like as insurance companies.

In addition, you are allowed to deduct the part of the employee’s share of Social Security and Medicare taxes that was not collected through tips. You are also allowed to deduct the payments for group term life insurance that were paid out to former workers.

Finally, you are eligible to deduct the amount of Social Security tax withheld from payments for COBRA premium assistance. You need to tally up all of these changes, and then enter the total on Line 8.

If you enter the entire amount of tax deposits that you made during the quarter on line 11, and then remove the total amount of deductions that you made on lines 8 and 12e, you will be able to calculate whether or not you overpaid or underpaid your employment taxes for the quarter.

If the total amount of taxes that you put on line 10 is more than the amount of tax deposits that you submit on line 13, you will have a balance due.

Fill in this outstanding balance on line 14. If the sum of your tax payments that you report on line 10 (total taxes) is lower than the amount of tax deposits that you report on line 13 (tax deposits), then you have overpaid your taxes for the quarter.

You have the option of requesting a refund or using the excess payment against the taxes that you will be responsible for paying during the next quarter.

Instructions for Filling Out Form 941

You have the option of mailing your completed Form 941 and payment to the Internal Revenue Service. E-filing, often known as electronic filing, is another option for submitting your Form 941. You will save time by filing electronically, it is a safe method, and you will get an acknowledgement of receipt within one business day.

If you wish to do your own e-filing, you will need to acquire software that is authorized by the IRS. You will furthermore be required to pay a charge in order to submit the returns online.

In the end, you’ll need to sign your form, and you may do so either by using an electronic signature or by scanning a paper copy of Form 8453-EMP, Employment Tax Declaration for an IRS e file Return.

If you want to apply for the electronic signature online, you should wait for a period of forty-five (45) days for a pin to be sent to you.

You also have the option of enlisting the services of a seasoned accountant or a trustworthy payroll provider to handle the electronic filing of these papers on your behalf.

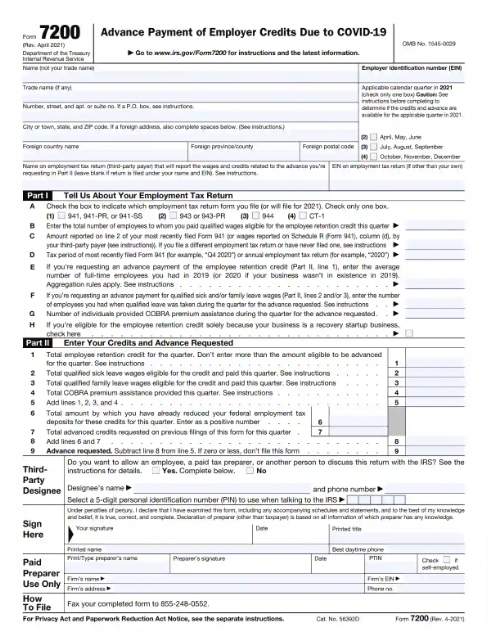

7200 Form

During COVID-19, one of the numerous initiatives designed to assist companies was supplemented by the addition of a new form, which was designated as Form 7200. It is used to make a request for an advance payment of the tax credits for qualifying sick leave earnings and qualified family leave wages, in addition to the employee retention credit.

Form 7200 Instructions

First, at the very top of the form here, or here write down the name of your company, your employer identification number (EIN), and the address of your company. Check that all of the information provided is consistent with the information the IRS has on record about your company.

Step 2: After that, check the box that corresponds to the calendar quarter that corresponds to the one for which you are submitting form 7200. It is not possible to submit Form 7200 for two different quarters at the same time.

Complete Your Employee Tax Returns is the Topic of Part 2.

Indicate on Line A the form of Employment Tax Return that you will be filing for the year 2021.

This may be either Form 941/PR/SS, Form 943/PR, Form 944/SP, or Form CT-1.

At Line B, you will need to provide the total number of workers whose pay were considered eligible for that particular quarter.

On line C (this does not apply to companies that have not yet submitted their first employment tax returns) complete the amount that should be filled in for the entire amount paid as eligible earnings, tips, and compensation according to their Form 941.

If you do not submit tax form 941, you may still report your tax returns using the information shown below, which is taken from the recommendations provided by the IRS:

Form 941-PR, line 5a, Enter the amount that was reported in the first column.

Taxable social security salaries are reported on line 5a of the Form 941-SS.

Enter the amount that was reported in the first column.

Line 2 of Form 943: Qualified Wages that are liable for social security taxes.

Form 943-PR, line 2.

Wages, tips, and other remuneration should be reported on line 1 of Form 944.

Form 944(SP), line 1.

Line 1 of Form CT-1, Employer Tax Credit for Tier 1 Compensation (other than tips and sick pay). In the field labeled “Compensation,” write the amount that was reported.

At Line D, provide the tax period that corresponds to the most recent employment tax return that you have submitted.

If you have not yet filed any employment taxes, you may ignore the rest of this line.

At Line E, you are going to need to enter the average number of full-time workers that you had throughout the prior year.

If you are seeking an FFCRA advance credit, you will need to mention on Line F how many workers you had at the time that they submitted their applications for qualifying leave during that quarter.

Enter Your Credits and the Amount of the Advance Requested Here (Part 3)

At the first line, you’ll need to enter the whole amount of the employee retention credit advance for the quarter. This should be equal to fifty percent of the family-friendly salaries that are given to your staff members.

In lines 2 and 3, you’ll need to enter the earnings for qualifying sick leave and qualified family leave that you paid out during that quarter.

You are able to enter the cost of eligible health plan expenditures for workers as well as any other pertinent information in this section.

At Line 4, provide the amount of help with COBRA premiums that was provided by your company during the quarter.

Line 5: Add the numbers that are written in lines 1, 2, 3, and 4 and enter the total that is obtained in this line.

Line 6 asks you to fill in the amount if you have already reduced your total federal employment tax deposit for these credits in this quarter. If so, you should have done so by this point.

At line 7, provide the total amount that covers all advances that you have previously requested for during this time period.

Add the information from lines 6 and 7 together and record it on line 8.

Line 9: Take the difference between lines 8 and 5 and insert it in the corresponding space. If the result is negative, zero, or less than $25, then you do not qualify for any of the advanced tax credits, and there is no need for you to complete the form.

Please include details about your Third-Party Designee (If any).

The owner of a company gives permission to a third party to represent them in discussions with the IRS on their Form 7200. In the Third-Party Designee section, you should indicate your desire to have one by checking the “Yes” box and providing the information that is needed.

If the IRS needs any further information concerning your Form 7200, they may get in touch with your third-party designee. Additionally, the third-party designee is able to.

Get in touch with the Internal Revenue Service if you want information regarding the processing of your Form 7200.

On your behalf, we will respond to particular notifications from the IRS about the production of your Form 7200.

Signature-Based Authorization for Formal Use

The following individuals may be eligible to sign your Form 7200, depending on the nature of your company:

In the case of sole proprietorships, the person who owns the company by themselves.

In the case of corporations, the president, vice president, or another approved main official.

In the case of partnerships and other types of organizations that are not incorporated, an authorized partner, member, or officer.

In the case of a single-member limited liability company, this would be the LLC’s owner or an approved primary officer.

The trustee or executor of an estate is referred to as the fiduciary.

It is possible for a lawfully authorized agent of the taxpayer who has filed a valid power of attorney to sign Form 7200 on the taxpayer’s behalf.

Form 7200 Common Mistakes To Avoid

EIN that is either incorrect or absent

Multiple calendar quarter choices

Incorrect calculations on lines 4, 7, and 8 of the form’s Part 2; failing to include the signature section

Form 7200 Example and Form 7200 PDF Fillable

This is what a Form 7200 looks like:

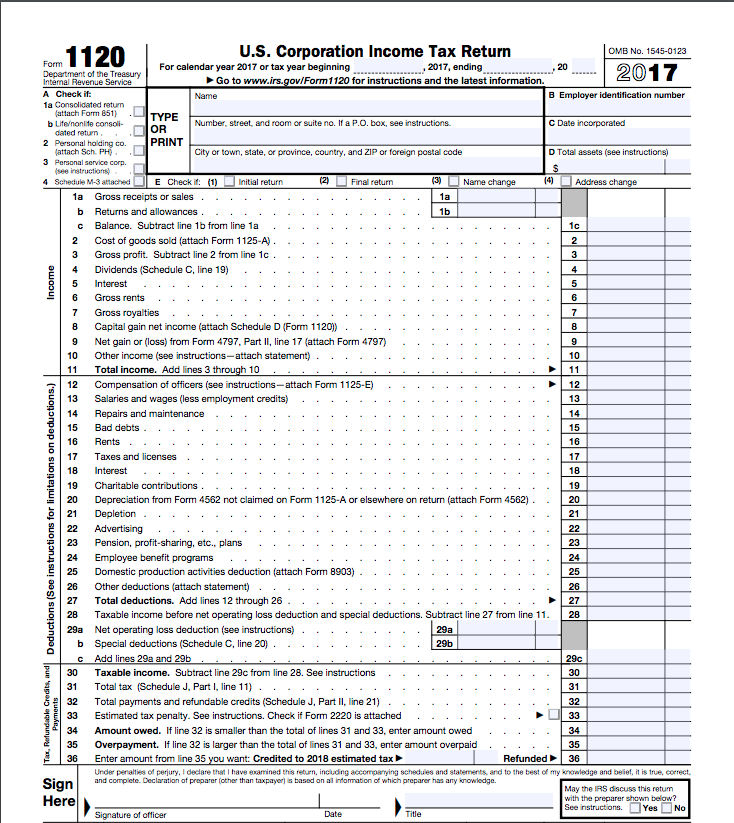

1120 Form 2022

Companies that are subject to C corporation taxation are required to submit their company tax returns using IRS Form 1120. Consider Form 1120 to be the C company version of the Personal Income Tax Return (Form 1040).

Companies that are taxed as C corporations, as opposed to other company forms, pay a corporate tax rate that is constant at 21 percent of their taxable revenue. The difference between a C corporation’s total revenue and the amount of its business tax deductions, losses, and credits is the corporation’s taxable income.

A pass-through entity is an organization that does not undergo the same level of taxation as a C corporation. The responsibility for paying income taxes is passed on to the business’s owners in pass-through businesses like sole proprietorships and partnerships, which do not pay taxes at the entity level.

There is no one tax rate that applies to all different forms of company revenue, including the following: The amount of money you make determines which tax bracket you fall into. The Internal Revenue Service (IRS) receives information returns from the vast majority of pass-through organization types, but these returns are not used for the purpose of taxation.

1120 Instructions

1. Assemble A Competent Tax Staff

Gather your tax team, which should include a corporate tax specialist and corporate tax filing software, to begin the process of submitting your taxes. This will get you started.

Because owners of C companies, also known as shareholders, are not regarded to be self-employed, they are unable to utilize tax preparation software designed for those who are self-employed. Common providers of tax software, such as TurboTax, are among the providers that provide software alternatives for C corporations.

Because of its notoriously lengthy nature, you should seek the assistance of a qualified tax expert while filling out Form 1120.

If your C company is very simple and tiny, you could find yourself inclined to submit Form 1120 all by yourself. Just make sure that you’ve found a corporation tax professional who is ready to answer questions and take over if necessary before you get started.

2. Complete Most Of The Information On Page 1

Get your fillable form here or get your traditional form here.

The first page of Form 1120, which provides the IRS with an overview of your company’s tax condition, is sometimes referred to as the “face” of the form. A significant portion of this may be completed by utilizing the information saved in your accounting program.

You will see that there are spaces available for you to fill in for the cost of goods sold, depreciation, profits and losses, tax credits, and the total lines.

3. Complete All Of The Necessary Schedules

When you submit your tax return using Form 1120, you will need to fill out these schedules.

Schedule C

C corporations, just like individuals, have the ability to invest in the stock of other businesses. C businesses use Form 1120 Schedule C to record the yearly dividend income that they get from their assets in other firms.

C companies are eligible to deduct a portion of their dividend income if they meet the requirements for the dividends received deduction. The percentage of ownership in another company that your company has will play a role in the computation of your deductible.

Schedule J

Form 1120’s Schedule J is available here.

On the tax return, Schedule J is where you list all of your tax credits. Image courtesy of the Author.

This is the section where you will compute the tax due for your C company. The tax computation that you began on the first page of Form 1120, which details your deductions, is continued in this portion of the form. In order to calculate your tax due, you will need to go to Schedule J and input any business tax credits and anticipated tax payments you have made.

Your taxable income, which may be found on page 1, line 30, should be multiplied by the federal company tax rate of 21 percent and entered on line 2, which is labeled “income tax.” Obviously, the computation isn’t always as easy as it seems, which is why you and your tax expert should go over the instructions for Form 1120 to find any exceptions and additional information.

Tax credits are one of the most efficient methods to lower your tax due since they decrease your tax payment by the same amount that they are worth, dollar for dollar.

Schedule K

The C corporation’s owners and assets in other businesses are probed further in the information request included in the Schedule K. A cash or accrual basis for accounting must first be selected for your business before you can proceed.

Schedule K is a relatively short form, and it does not need much information from Simple C businesses. It is highly recommended that you seek the assistance of a qualified tax expert with this matter if your company is a shareholder in another firm.

Schedule L

The balance statement for your firm, as shown in your records, is on Schedule L. To complete this step, you will need to open the balance sheet that is current as of the end of the year in your accounting program.

Both of the M-1 and M-2 schedules

The Internal Revenue Service (IRS) uses a method for calculating some costs, such as depreciation, that differs from the method required by Generally Accepted Accounting Principles (GAAP) for financial reporting that is not related to taxes. The discrepancies between your financial statements used for bookkeeping reasons and those used for tax purposes are broken down on schedules M-1 and M-2 and explained to the IRS.

Due to the complexity of the M-1 and M-2 schedules, you should consult a tax expert for assistance in completing them.

4. Check For Any Additional Necessary Schedules

It is possible that you may need to affix supplementary forms or schedules to the Form 1120 depending on the operations of your company.

The following Are Examples Of Common Attachments:

Businesses that have a cost of goods sold must file using Form 1125-A.

Corporations having gross revenues of at least $500,000 are required to use Form 1125-E to detail their officer salaries.

Fill out form 4797 when selling any commercial property.

Fill out Form 4563 if you need to report depreciation or amortization.

Gains and losses on investments should be reported on Schedule D.

A person who specializes in company taxation need to have understanding of the various forms you are required to file together with Form 1120.

5. Go Back To The First Page

You are ready to finish the first page of Form 1120 after you have completed filling out the remainder of the form and all of the needed attachments. You may fill in any gaps on your tax return by going back to the front of the form.

6. Go Through Your Tax Return And Submit It

You’re done!

Either e-file Form 1120 using your own tax software and or an all in one pdf form solution, do it yourself, or have your tax accountant do it on your behalf, but be aware of the fact that doing the ERC filing calculation and process is a very complicated matter and even the most up to date lawyers and accountants still do not know how to do it the right way. The best solution is to let an ERC professional advisor do it for you for free. Here is the best done for you solution available right now!

1120 Form Example

This is an example of what a Form 1120 looks like:

Check if You Qualify for the Employee Retention Credit Today?

Just answer a few simple questions here:

http://harperstribune.com/ercfund

Please only fill out the form if the company in question is based in the United States, has 5 W2 employees, and has not previously received ERC.

TOOLS:

Best Employee Retention Tools That Help Your Businesses Gain An Advantage To Get Back The Max ERC Credit Per Employee From The IRS + Helps With Business Reputation & Productivity

We have assembled a list of the top 10+ employee retention tools for small to mid sized companies so that you can build an organization that people want to join and remain a part of. This will help you establish an environment where people want to work and want to work there.

Let’s get started on the strategy to ensure that your brilliant staff continue to feel secure and content in their jobs.

Best Employee Retention Tip:

If we continue with the theme of safety, one smart strategy that companies are using to keep their staff this year is to investigate whether or not they are eligible for the Employee Retention Credit program. Some companies are raking in seven-figure rewards after going through an online qualifying procedure that takes just sixty seconds.

Tools, Software, and Applications for Employee Retention

ERC Tool 1 – Caroo

Caroo got its name from the company’s unwavering commitment to the welfare of its workforce. On this platform for recognition, the distribution of presents and other forms of non-monetary prizes is made simple. In order to maximize the health of your business, Caroo provides a wide range of services, from high-quality nourishing snacks to activities that strengthen teamwork.

Every game, snack, and item is selected with great care by HR professionals and then sent directly to the customer’s home or place of business. It is almost certain that your team of superstars will like the corporate gift boxes that you selected for them.

Caroo is the place to go if you need any further information.

ERC Tool 2 – Bonusly

Bonusly is an all-in-one employee recognition, survey, and rewards platform that enables businesses to cultivate teams that are more engaged, productive, and results-oriented while also being in line with the culture of gratitude that permeates the organization.

Eliminating silos and making it possible for workers and managers alike to show appreciation to one another and recognize one another through the use of hundreds of built-in features and integrations is something that can be accomplished with the help of Bonusly.

Visit Bonusly if you need any more information.

DID YOU KNOW?

Your ERC request for an ERC refund might be denied by the IRS if there is missing, incomplete, or erroneous information, thus it is imperative that you double verify every aspect of your request. When you are finished, you can send the completed form to request an ERC refund the following fax number: 855-248-0552.

However, this process can be time consuming, unproductive, cost intensive, and unsuccessful in the end if you don’t employ a professional who knows what they are doing. Instead use a professional ERC advisor who does the whole process for you for Free and delivers results.

Check out this free done for you ERC solution.

ERC Tool 3 – SwagUp

SwagUp is the all-in-one platform for personalised swag that ensures optimal levels of employee pleasure, engagement, and retention. You will be able to create, implement, and automate the distribution of your branded swag and presents by using this recognition solution.

When it comes to retaining employees on remote teams, SwagUp is the ideal solution since it enables you to keep your digital nomads on the same page as the rest of their colleagues and ensures that they continue to produce high-quality work.

Check out SwagUp if you want additional information about this.

ERC Tool 4 – Blueboard

Blueboard is a means of rewarding and recognizing staff members that also facilitates competition amongst colleagues. Now, instead of only waiting on the management to celebrate milestones, everyone in the firm can cheer on each other’s large and tiny achievements. This includes both the big and the minor victories.

This platform for providing experiential incentives provides individualized employee experiences, such as parasailing and VIP concert tickets, which have been shown to significantly increase employees’ level of commitment over the long run. One of the most appealing aspects is that workers have the ability to customize their experience by selecting the kinds of activities that most appeal to them. After that moment, Blueboard will take care of everything else to make sure that your staff has the best time of their professional life!

The most effective use of this memory aid is for daily recognition.

Visit the Blueboard if you need any further information.

ERC Tool 5 – Weve

Weve may have gotten its name from the fact that it is one of the greatest platforms for weaving employee appreciation into the day-to-day operations of a business setting. In a nutshell, Weve maintains a dynamic and interesting atmosphere in the workplace. How? To begin, there are various ways, but the most important one is to improve employee reward ceremonies.

Weve facilitates the gathering of teams in a digital setting and enables live award shows that may be seen simultaneously by up to 10,000 people. In addition, you have the option of including personalized trivia and entertaining information about award winners or the firm, streaming an exclusive message from the CEO, or requesting that someone the award winner respects offer a pre-recorded shoutout!

Visit this site, Weve, for more information.

ERC Tool 6 Bambee

Bambee can assign a human resources manager to your organization for a cost that is less than one hundred dollars per month. A comprehensive HR audit, HR-compliant policies, employee onboarding and terminations, HR guidance, staff training and development, and the peace of mind that comes with knowing that HR experts are backing up your HR strategy are all provided by this employee retention tool that is also very cost effective.

Bambee will also strive to ensure that the HR rules match the way you now manage your company and are in line with the requirements you have specified.

The most effective use of this retention technique is for: the culture of the company.

Bambee is the place to go if you want additional information.

ERC Tool 7 – Nectar

Nectar is a tool for employee appreciation that can be used across the board, and it is designed to assist everyone in your business support one another. This positivity-enhancing platform provides managers and team members with an incentive to perform at their highest level and to remain with the company for the long haul.

Peer-to-peer spotlights and recognition have a different impact than even being spotted by the CEO, and Nectar offers hundreds of connectors with other engagement platforms like as Slack and Microsoft Teams. In conclusion, having a bespoke swag shop enables you to add a giving component to your recognition program, which results in prizes that are genuinely memorable for employees.

Nectar is the place to go if you want additional information.

ERC Tool 8 – Zenefits

Zenefits is a firm that focuses on making complicated aspects of the contemporary workforce easier to understand and manage. With the help of our HR software, you won’t have any trouble keeping track of your employee’s compensation, perks, and paychecks. When you use Zenefits, you’ll have more time on your hands to concentrate on what really matters: operating your company.

Zenefits is an excellent solution for human resource experts, particularly those who are searching for a straightforward method to manage their employees. Zenefit has this covered thanks to its fast onboarding and PTO tracking capabilities, in addition to providing all of the additional resources you want in an one location.

Streamlining onboarding, benefits, payroll, and paid time off is where this employee retention solution shines the brightest.

Check out Zenefits if you want to learn more about it.

ERC Tool 9 – Outback In Person Events and Outback Team Building Events

Outback Team Building is your one-stop destination for all of your requirements relating to team building. The staff at Outback will help you brainstorm new ideas or offer suggestions relating specifically to your company. They have years of experience in finding activities that are outside the box and that appeal to many different groups, as well as all different types of budgets and interests that are similar.

The goal of this method for retaining employees is to strengthen the bonds between members of the team. motivation of workers and involvement of workers

Building teams is where this retention tool shines the brightest.

Please visit Outback Team Building if you need any more information.

ERC Tool 10 – Assembly

Assembly is the best option for you to consider if you are seeking for a method to acknowledge and appreciate the work of your staff. With the help of this platform for peer-to-peer recognition, it is much simpler for anybody to be acknowledged and rewarded in the here and now. You may even develop individualized awards that are tailored to each employee so that they are aware of just what it is that they have attained.

Because of Assembly, nobody ever needs to worry about slipping through the gaps again! Because of its straightforward and user-friendly user interface, it is very easy for any member of your team to become engaged and begin recognizing their teammates right immediately.

Visit Assembly if you need any more information.

ERC Tool 11 – Monday.com

Monday.com boasts that it is the “Uber of resource management,” and despite the magnitude of this claim, the company is equipped with the tools necessary to fulfill its promises.

This solution for retaining employees provides real-time insights into projects, visibility into workflows and analytics, and enps-boosting integrations and updates. Additionally, it offers time tracking and automation, as well as views of timelines.

Monday.com is where you should go to get additional information.

ERC Tool 12 – Confetti

Confetti is a platform that improves job happiness, health, productivity, and culture in the workplace by recognizing and retaining employees in a smooth and comprehensive manner from beginning to finish. This tool for retaining employees makes it easier to give out spot bonuses, spot awards, and other sorts of recognition and experiences that do not involve money.

The very best part is that each and every vendor has been hand-picked to provide the most unforgettable experiences and occasions that your staff members could ever want to have. Confetti will assist you in dominating your workplace by providing you with both hosted games and shippable experiences.

Confetti is the place to go if you want more information.

ERC Tool 13 – The QuizBreaker

QuizBreaker is the team-building quiz platform that is perfectly optimized for keeping teams tight-knit, regardless of whether employees are working from home, commuting, or working on some other flexible workplace model. This is because QuizBreaker questions are designed to be answered by everyone on a team simultaneously. Your team will be able to take the team building quizzes with them wherever in the globe since they will be sent to them.

They will have the opportunity to participate in brief quizzes, enjoyable gamification, and automated processes (you can schedule quizzes for a particular time each week).

The most effective use of this memory aid is to have daily fun with your colleagues.

QuizBreaker is the place to go if you need any further information.

ERC Tool 14 – BambooHR

The Human Resources (HR) solution known as BambooHR assists businesses in managing the many stages of the employee lifecycle. It makes every part of recruiting, salary management, and data analysis more streamlined while also giving tools for sustaining business culture. As a result, it makes it much easier to develop fantastic teams from inside an organization or attract fresh talent from the outside!

Visit BambooHR if you are interested in learning more.

ERC Tool 15 – Fond – The Fond Suite

Fond is a platform that runs in the cloud that makes it simple for managers to recognize and reward their staff members, as well as for those staff members to cash in their rewards. You may design bespoke programs in a matter of minutes with its straightforward user interface, without the need for assistance from IT or HR. Real-time analytics provide another way to monitor employee participation, allowing everyone to stay abreast of their progress.

Check out Fond for more information if you’re interested.

ERC Tool 16 – IRS Tools

There are many tools that are provided to businesses for Free by the IRS. You can check out all the free tools right here:

https://www.irs.gov/help/tools

7 additional ERC Tips To Increase Business Reputation And Make Employees Stick

Advice for Developing an Employee Retention Program advice-for-developing-an-employee-retention-program

Tip 1 – Offer a Competitive Wage and Benefits Package

If we were being honest, we wouldn’t be working most jobs if money wasn’t a consideration. No matter how much you like what you do for a livelihood, the fact remains that you are doing it in order to pay the bills. It’s estimated that over half of all workers who leave their jobs do so because the pay and perks they get aren’t competitive enough. Always keep in mind that your workers are an investment in your company and make sure that your finance and human resources departments are involved in determining what you can fairly provide.

Tip 2 – Develop an Outstanding New Employee Orientation Program

The process of onboarding new employees is one of the first chances to make an impression on them, and it has the potential to set the stage for the remainder of their time spent working for your firm. It might take a new employee up to two years to attain the same levels of productivity as a colleague who has been with the company for longer. Because of this, it is important to make sure that your top talent is welcomed onboard and that realistic expectations are established.

Tip 3 – Encourage Continuing Education and Training

The last thing any worker wants is to have the impression that their professional progress and personal growth are being held back. Because of this, it has been discovered that a lack of opportunity for professional growth is directly connected, in part, to high turnover rates. You should directly ask your workers what kind of professional growth and development they would want to pursue, and then provide them with the tools and assistance they need to realize their goals. In the very competitive business environment of today, one of the most important factors in keeping personnel is providing ongoing support for those individuals while also looking into the future.

Tip 4 – Lessen the Ache and Discomfort Experienced by Employees

Helping employees feel less pain and suffering is a step in the right direction. Your workers are not a financial burden since they are people; thus, it is imperative that you do anything you can to relieve the difficulties that they have in their jobs. This applies even to your button line. These straightforward modifications are self-evident in many fields, like as retail, where it is common practice to let employees take breaks while seated rather than requiring them to stand the whole of their shifts. In other cases, you will need to look further or question someone directly. Implement methods of gathering feedback at your place of employment.

Tip 5 – Keep a close eye on your superiors

The actions of a competent manager may have a domino effect, but so can the actions of a poor manager. Managers, like everyone else, have a need for assistance in becoming their best selves. You should always encourage managers to master soft skills such as compassion, kindness, empathy, patience, and basically everything that can be categorized as falling under the umbrella of emotional intelligence (EQ), in addition to the technical aspects of the job. This is something you should always do.

Tip 6 – Be Patient and Accurate When Hiring The Initial Occurrence

According to Glassdoor, thirty-five percent of businesses anticipate workers resigning within the next year. Yes, you read that right; one-third of businesses anticipate people leaving before they have even begun working for the company. It is of the utmost significance that managers participate in the processes of recruiting and onboarding new employees. In this way, applicants may be screened and provided with a solid basis on which to construct their careers. Always be honest and forthright when discussing the expectations of new hires.

Tip 7 – Use Employee Retention Tools

People have these concerns regarding different employee retention tools, but what exactly is meant by the term “employee retention tool”?

It means a platform or program that helps boost employee engagement, employee happiness, peer-to-peer connection, and, of course, employee retention is referred to as an employee retention tool.

How much does it pay to use a product that helps retain employees you might ask.

The price of an employee retention tool may range anywhere from a few dollars to several hundred dollars, with the range mostly determined by the pricing model of the tool, the advantages it offers, and the access it provides to particular capabilities that are not available with other tools.

These tools can encourage improved employee retention at your organization.

And some of the ways you may do this is you can improve employee retention at your company by establishing an employee retention program, providing your managers with the employee retention tools they require, and obtaining their buy-in and commitment to make the program successful. This will allow you to promote better employee retention at your company which increases your employees stick rate helping your employees and your business thrive beyond today into the future which is the goal of every small business and entrepreneur online or offline.

Claiming the ERC fund is just one way to help improve your employee retention rate and using an array of many tools in concert will help increase your business reputation and help achieve your employee goals in terms of retention and satisfaction.

Make sure to ask for professional help when it comes to your employee retention credit so that your employees and your business can thrive way beyond 2022. Click here to do it the right way done by a professional ERC advisor who is doing the whole process for your business.

Tools Mentioned In This Article

Fillable Tax Forms – Your All In 1 Solution for Online Forms & Documents

More Employee Retention Credit Tips

https://internetmoneykings.com/employee-retention-credit-2022

https://internetmoneykings.com/bottom-line-concepts-review