Kris Harper

Best Online Instructor Jobs: Remote Roles for 2024+

Heading into 2024, teaching online is where it’s at. It’s not just a trend anymore—it’s a whole new way of working. Whether you’re a seasoned educator or just dipping your toes in, online instructor jobs remote are opening up a world of possibilities. You get to teach from home (or anywhere, really), set your own hours, and reach students from all over the globe. It’s flexible, exciting, and full of opportunities for those ready to jump in.

Key Takeaways

- Remote teaching is booming as more people seek flexible learning options.

- Working as an online instructor means no commute and the ability to set your own schedule.

- A strong online presence can help attract students and grow your teaching business.

- Instructors can teach a wide range of subjects, from traditional academics to specialized skills.

- Staying updated with new tech and teaching methods is important for success.

Who Should Read This Article?

This article is perfect for a wide range of individuals looking to explore or expand their opportunities in online teaching. Whether you’re considering a full-time career shift or just a side hustle, here’s who will benefit from reading this:

1. Aspiring Online Teachers

If you’re passionate about teaching but don’t want to be tied to a traditional classroom, this article provides the essential information to help you get started as an online instructor. From understanding the tools and platforms available to knowing how to effectively communicate in a virtual classroom, you’ll find all the basics you need to jump into the world of online education.

2. Experienced Educators Seeking Flexibility

For seasoned educators looking to transition from in-person to online teaching, this article offers insights into the benefits of remote teaching, including the flexibility to work from anywhere and set your own schedule. You’ll also get tips on how to transfer your existing skills into the online space and grow your presence on digital platforms.

3. Side Hustlers

If you’re looking for a flexible side income that can work around your schedule, online teaching is an excellent option. Whether you’re a working professional, a stay-at-home parent, or a college student, this article will guide you through how to make online teaching work as a side hustle. Learn how to pick the right subjects, set competitive rates, and maximize your earnings without quitting your day job.

4. Career Changers

For those considering a career change or exploring new avenues to make money from home, online teaching offers the chance to build a rewarding, flexible income stream. This article will help you understand how to leverage your existing skills and knowledge, even if you don’t have formal teaching experience, to break into the online education field.

5. Entrepreneurs & Content Creators

If you’re already running a blog, YouTube channel, or other online business and looking to diversify your revenue streams, becoming an online instructor could be a perfect fit. Whether you’re teaching a niche topic or leveraging your existing audience to sell courses, this article shows you how to use your platform to grow your teaching business.

6. Individuals Seeking Work-Life Balance

For anyone desiring better work-life balance, teaching online offers the ability to work remotely and manage your own schedule. This article is perfect for those who value flexibility in their careers, whether you want to spend more time with family, travel, or just have more control over your time.

Whether you’re looking to start a full-time career or a flexible side hustle, this article will provide you with the tools and resources to succeed as an online instructor.

Why Remote Online Instructor Jobs Are Thriving

The Rise of Digital Learning

The shift to digital learning is like a tidal wave that’s been building for years, and now it’s crashing onto the shores of traditional education. More and more folks are looking for flexible, online learning options. Digital learning has taken off, thanks to tech advances and changing attitudes. With high-speed internet and digital tools, teachers can now reach students in every corner of the globe. This shift isn’t just about convenience; it’s about creating new ways to learn and teach that fit our busy lives.

Flexibility and Freedom

One of the biggest draws of online teaching is the freedom it offers. Imagine setting your own schedule, working from anywhere—even in your pajamas if you want! This flexibility is a game-changer for those who want to balance work with other commitments. Plus, there’s no commute, which means more time for family, hobbies, or just relaxing. It’s about layering flexible education jobs to suit your lifestyle, giving you the power to choose roles that align with your personal goals.

Global Reach and Impact

Teaching online isn’t just about convenience; it’s about making a real impact. You can connect with students from all over the world, sharing your knowledge and learning from them too. This global reach means you can teach diverse groups, bringing together students from different backgrounds and cultures. It’s a chance to broaden your horizons and theirs, making education a truly global experience.

Online teaching opens doors to new opportunities and experiences. It’s not just a job; it’s a way to connect with the world and make a difference. Embrace the change and see where it takes you!

Top Platforms to Find Online Instructor Jobs

Exploring Popular Job Boards

When it comes to finding online instructor jobs, job boards are your best friend. They’re like treasure maps, leading you to hidden gems of opportunities. Here are some popular ones to kickstart your search:

- FlexJobs: Known for its focus on remote and flexible jobs, FlexJobs offers a variety of teaching positions. It’s a paid service, but many find it worth the investment for the quality of listings.

- Indeed: This giant job board has a section dedicated to remote jobs. You can filter your search to find online teaching roles specifically.

- LinkedIn: Not just for networking, LinkedIn’s job search feature lets you find remote instructor positions and see if you have any connections at the hiring company.

Networking with Educators

Networking is more than just a buzzword; it’s a powerful tool in your job search arsenal. Connecting with other educators can open doors you didn’t even know existed. Here’s how:

- Join Online Communities: Platforms like Facebook and Reddit have groups for online educators where you can share tips and job leads.

- Attend Virtual Conferences: These events are excellent for meeting fellow educators and learning about job opportunities.

- Engage on Professional Networks: LinkedIn isn’t just for job hunting. Engage with posts, share your insights, and connect with educators in your field.

Leveraging Social Media

Social media isn’t just for sharing memes and cat videos; it’s a goldmine for job opportunities. Here’s how you can use it to find online instructor jobs:

- Twitter: Follow educational institutions and job boards. They often post job openings and updates.

- Instagram: Believe it or not, some educators and institutions use Instagram to connect with potential hires. Follow hashtags like #onlineinstructor or #remotejobs.

- YouTube: Some educators share their experiences and job hunting tips on YouTube, providing insights into finding remote teaching jobs.

In the digital age, your next teaching gig might just be a tweet or a post away. Stay active, stay connected, and keep your eyes peeled for opportunities.

Skills You Need to Succeed as an Online Instructor

Mastering Virtual Classroom Tools

In the world of online teaching, being tech-savvy isn’t just a bonus—it’s a necessity. You’ll need to get comfortable with various digital tools that make virtual classrooms tick. These include video conferencing software, learning management systems, and even online whiteboards. Imagine having to switch gears quickly if your primary tool goes down; adaptability is key. A solid understanding of these tools ensures that your lessons are smooth and engaging, keeping students hooked from start to finish.

Here are some key tools to familiarize yourself with:

- Video Conferencing Software: Tools like Zoom, Microsoft Teams, and Google Meet are essential for conducting live classes. They offer features like screen sharing, breakout rooms for group discussions, and recording options for students who need to review lessons.

- Learning Management Systems (LMS): Platforms such as Google Classroom, Canvas, and Moodle help organize course materials, assignments, and grades in one central location, simplifying the learning process.

- Interactive Whiteboards: Tools like Jamboard, Miro, and Whiteboard.fi allow you to visualize concepts and collaborate with students in real time, mimicking the feel of a physical classroom.

- Collaborative Learning Tools: Apps like Padlet, Kahoot, and Quizizz encourage active participation through quizzes, polls, and group activities. These are especially useful for keeping students engaged in a virtual environment.

- Content Creation Software: Tools like Canva for visuals, Prezi for presentations, and Loom for pre-recorded video lessons can elevate the quality of your teaching materials and help deliver content in an engaging format.

Why These Tools Matter

Using the right tools ensures a smoother workflow, better student engagement, and fewer technical hiccups. For example, having backup options like Google Meet in case Zoom crashes, or a secondary LMS like Edmodo can save you from interruptions. Being versatile with these tools not only boosts your teaching efficiency but also builds trust with your students by providing them a professional and seamless learning experience.

By incorporating these tools into your teaching, you’ll create a dynamic virtual classroom environment that keeps students excited to learn.

Effective Communication Techniques

Communication is the backbone of teaching, especially online. You need to convey your lessons clearly and keep students engaged without the benefit of face-to-face interaction. This means using clear language, being concise, and perhaps most importantly, being an active listener. Listening to feedback and adapting your style is crucial. Also, having a knack for reading virtual cues can help you gauge how well students are grasping the material.

Continuous Professional Development

The learning never stops, even for teachers. To stay on top of your game, you need to keep updating your skills. This could be through online courses, webinars, or even just networking with other educators. The aim is to keep your teaching methods fresh and relevant. It’s also about embracing new educational trends and technologies that can make your teaching more effective. Remember, the more you learn, the more you can offer your students.

In the ever-evolving landscape of online education, keeping your skills sharp and your mind open to new ideas can make all the difference in your teaching journey.

Qualifications & Certifications for Becoming an Online Teacher

To thrive in the online teaching space, having the right qualifications and certifications can give you an edge. While some roles may not require formal teaching credentials, obtaining certifications or enhancing your expertise can significantly boost your credibility and employability. Here’s what you need to know:

1. Basic Qualifications

- Bachelor’s Degree: Most online teaching positions, especially for academic subjects, require at least a bachelor’s degree in a relevant field.

- Subject Matter Expertise: For specialized or skill-based courses, deep knowledge and hands-on experience in your subject area are key.

- Teaching Experience: Previous teaching or tutoring experience, either in-person or online, is often preferred but not always mandatory.

2. Teaching Certifications

Earning teaching certifications can demonstrate your ability to effectively deliver lessons and manage virtual classrooms.

- TEFL/TESOL Certification: For teaching English as a second language, certifications like TEFL (Teaching English as a Foreign Language) or TESOL (Teaching English to Speakers of Other Languages) are essential.

- State Teaching License: For K-12 roles, a valid teaching license in your country or state may be required.

- Adult Learning Certification: Programs like the Certificate in Teaching Adults (CTA) are ideal for those focusing on adult learners.

3. Online-Specific Certifications

To excel in virtual teaching, consider certifications tailored to online education:

- Google for Education Certified Educator: Demonstrates proficiency in using Google tools like Classroom, Docs, and Drive for teaching.

- Microsoft Certified Educator (MCE): Focuses on integrating Microsoft technologies into educational practices.

- Coursera Online Teaching Certification: Offers training in designing and delivering effective online courses.

- ISTE Certification for Educators: Covers digital-age teaching methodologies and best practices for integrating technology in education.

4. Skills-Based Certifications

Online platforms often seek instructors with skills in high-demand areas. Consider certifications to showcase your expertise:

- Coding & Tech: Certifications from platforms like Udemy, edX, or Codecademy in programming languages or software development.

- Business & Marketing: Google’s Digital Marketing Certification or HubSpot Content Marketing Certification for business-focused teaching.

- Creative Skills: Adobe Certified Professional or similar certifications for teaching design and creative software.

5. Continuing Professional Development (CPD)

Staying updated with industry trends is essential for maintaining relevance:

- Webinars and Workshops: Participate in online seminars on emerging educational technologies or teaching strategies.

- MOOCs: Massive Open Online Courses from platforms like Coursera, edX, and FutureLearn offer affordable, flexible learning options for educators.

- Memberships in Teaching Organizations: Groups like the International Society for Technology in Education (ISTE) or the Association for Talent Development (ATD) provide access to valuable resources and training.

6. Higher-Level Degrees and Specializations

For advanced roles or to enhance your credibility, consider pursuing further education:

- Master’s in Education (M.Ed.): A master’s degree with a focus on online teaching, curriculum design, or educational technology.

- Ph.D. in Education: Ideal for those aiming for leadership or research positions in education.

- Specialized Certifications: Fields like special education or early childhood education often require additional training.

7. Platform-Specific Requirements

Some online teaching platforms have their own qualification standards:

- VIPKid or Magic Ears: Typically require a bachelor’s degree and a TEFL/TESOL certification.

- Udemy or Skillshare: Emphasize subject expertise but may not require formal teaching qualifications.

- Outschool: Allows teaching unique or niche topics with minimal formal qualifications but values experience.

Invest in Your Future as an Online Teacher

While qualifications can open doors, your passion for teaching, willingness to learn, and ability to adapt to the digital landscape are equally vital. By pursuing relevant certifications and enhancing your skills, you’ll not only increase your employability but also provide high-quality learning experiences for your students. Take the first step and choose the path that aligns with your goals and teaching aspirations!

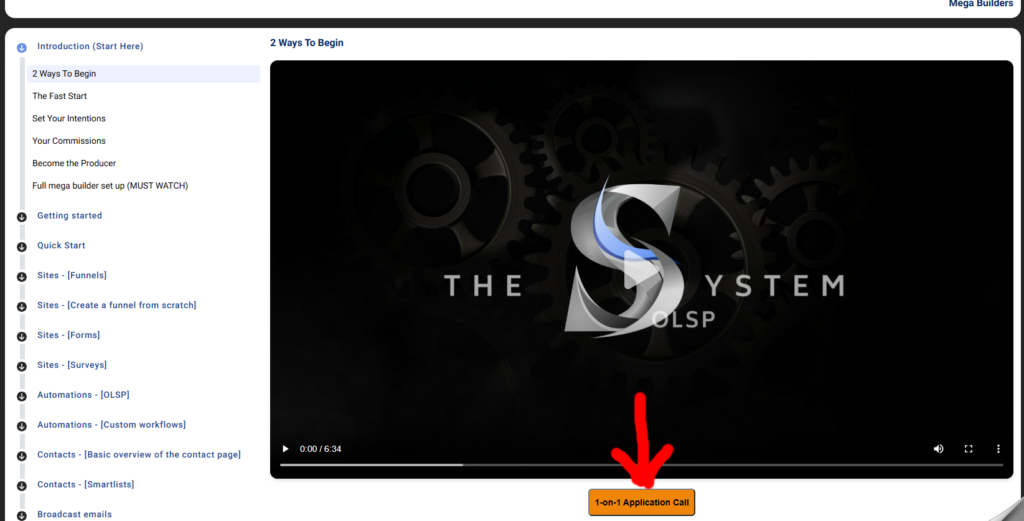

How to Get Started with Online Instructor Jobs

Getting started as an online instructor might seem daunting at first, but with the right approach, it’s totally doable. Here’s a step-by-step guide to help you kick off your journey.

Building Your Online Presence

First things first, you need to make yourself known in the online world. Creating a strong online presence is essential. Think of it as your digital business card. Start by setting up a professional website where you can showcase your skills, experiences, and any teaching materials you’ve developed. Use social media platforms to your advantage—network with other educators, join relevant groups, and share insights or tips related to your teaching field. Blogging about your subject is another great way to establish yourself as an authority and attract students.

Choosing the Right Subjects to Teach

When it comes to picking subjects, focus on what you know and love. This is where you can really shine. Consider your educational background, work experience, and personal interests. Are there topics you’re particularly passionate about? Maybe there’s a niche area where you have unique insight. Remember, teaching something you’re enthusiastic about not only makes the process enjoyable but also more engaging for your students.

Setting Competitive Rates

Pricing your courses can be tricky. You want to be competitive, but you also need to value your time and expertise. Research what others in your field are charging. Check out platforms like FlexJobs to get a sense of the going rates for instructors in similar areas. Consider your level of experience, the complexity of the subject, and the amount of time you’ll be dedicating. Don’t undersell yourself, but also ensure your rates are attractive enough to draw in students.

Starting as an online instructor is a journey filled with learning and growth. With the right preparation and mindset, you can reach learners across the globe and make a real impact. Embrace the opportunity and let your passion for teaching guide you!

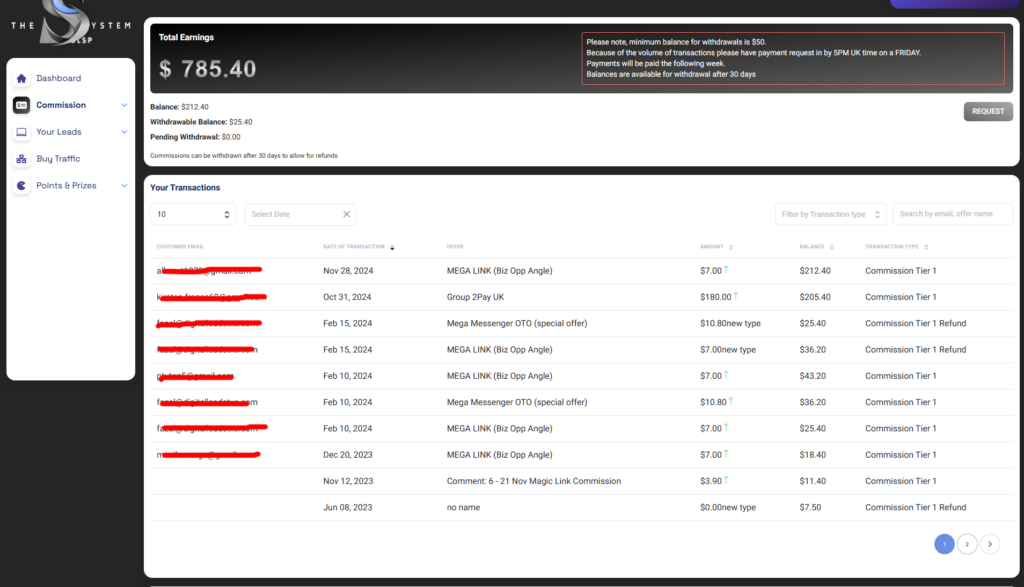

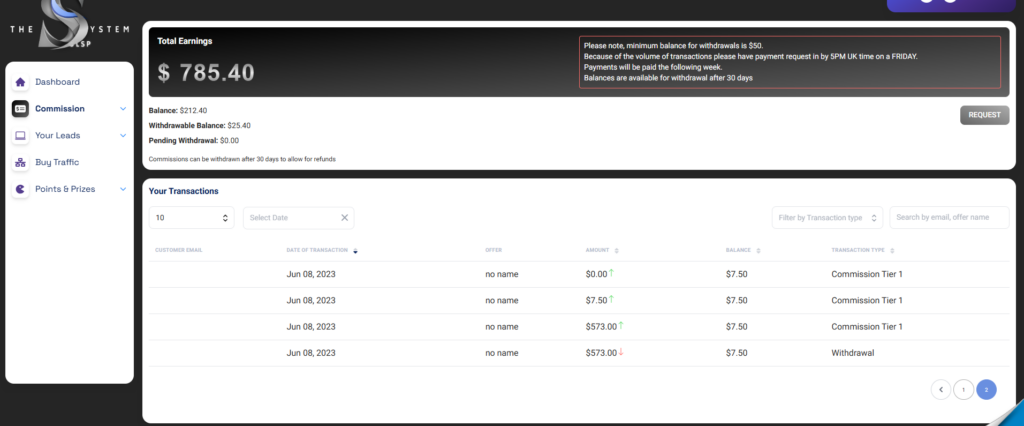

Payout & Earning Estimations for Online Instructors

As an online instructor, your earning potential can vary widely depending on several factors, including the platform you use, your qualifications, the subject you teach, and the number of hours you dedicate to teaching. While some online teaching positions offer a steady paycheck, others provide the flexibility to set your own rates or work on a per-session basis. Here’s a breakdown of what you can expect in terms of payouts and earning estimations:

1. Hourly Rates for Online Teaching

Hourly rates can differ based on the subject matter, your qualifications, and the platform you teach on. Below are general estimates for various online teaching roles:

- English as a Second Language (ESL) Teachers:

- Entry-level: $10 – $15 per hour

- Experienced: $15 – $30 per hour

- Highly Qualified or Specialized (e.g., TEFL Certified): $25 – $50 per hour

- Academic Tutors (Math, Science, History, etc.):

- Entry-level: $15 – $25 per hour

- Experienced: $25 – $50 per hour

- Specialized or Advanced Subject Expertise: $50 – $100+ per hour

- Specialized Instructors (Tech, Business, Creative Fields):

- Coding or Programming: $30 – $75 per hour

- Digital Marketing, Business Skills: $40 – $100 per hour

- Art or Design (using software like Photoshop or Illustrator): $25 – $70 per hour

2. Pay per Course or Lesson

Some platforms, especially those that focus on niche subjects or skills, offer payment based on the completion of a course or a single lesson rather than hourly rates:

- Udemy/Skillshare: Teachers can set their own course prices and earn revenue based on enrollments. Typically, you can expect to earn anywhere from $10 to $100 or more per course, depending on the course’s price and your share of the revenue. Udemy, for example, takes a commission, but you can also drive your own traffic and earn a larger portion of the sales.

- Outschool: Teachers earn between $10 and $80 per class, depending on the subject and class size. You can set your own rates and teach group lessons or private sessions.

3. Payout Models for Online Platforms

Different platforms have different payout structures, and understanding these is important for budgeting your earnings:

- Pay Per Lesson/Session: Many platforms pay teachers on a per-lesson or per-session basis. For example, VIPKid pays $14 – $22 per hour depending on your experience and the class duration.

- Revenue Share: Platforms like Skillshare or Teachable follow a revenue-sharing model, where you receive a portion of the income based on the number of students who enroll in your courses or subscriptions.

- Flat Rate: Some platforms offer flat rates for specific lessons or tutoring sessions. Chegg Tutors, for example, offers around $20 per hour.

4. Income Potential by Subject Area

Your income as an online instructor can also vary depending on the subject you teach. Here’s a general idea of what you might expect:

- ESL Teachers:

- Full-time (25-30 hours/week): $1,000 – $2,000 per month

- Part-time (10-15 hours/week): $400 – $1,000 per month

- Academic Subjects (Math, Science, etc.):

- Full-time: $2,000 – $4,000 per month

- Part-time: $1,000 – $2,500 per month

- Tech & Business:

- Full-time: $3,000 – $7,000 per month

- Part-time: $1,500 – $3,500 per month

- Creative & Specialized Subjects:

- Full-time: $2,000 – $5,000 per month

- Part-time: $1,000 – $2,500 per month

5. Additional Earning Opportunities

In addition to the basic hourly or course rates, many online instructors supplement their earnings through the following:

- Group Classes: Teaching multiple students at once can boost your hourly earnings. Platforms like Outschool or Preply allow you to charge more for group lessons.

- Upselling: Offering personalized feedback, coaching, or additional resources (e.g., study materials, recorded lessons) can add to your income.

- Creating Paid Resources: Some instructors sell supplemental materials (worksheets, lesson plans, study guides) on platforms like Teachers Pay Teachers.

- Affiliate Marketing: If you have a strong online presence, you can earn additional income by promoting educational tools and platforms through affiliate links.

6. Factors That Impact Earnings

Several factors affect how much you can earn as an online instructor:

- Experience & Credentials: The more experience and relevant certifications you have, the higher the rates you can command.

- Subject Demand: High-demand subjects, such as ESL, coding, and STEM fields, tend to pay more.

- Platform Reputation & Fees: Established platforms like VIPKid, Preply, and Chegg may take a cut of your earnings, but they also provide a steady stream of students.

- Time & Availability: The more hours you’re able to dedicate, the higher your potential income. However, working during peak hours (evenings and weekends) can also increase your earning potential.

Maximize Your Earning Potential

Becoming an online instructor can be financially rewarding, but success requires strategic planning, understanding your target market, and consistently improving your teaching methods. By choosing the right platforms, offering high-demand subjects, and continuously enhancing your skills, you can build a profitable and flexible career as an online teacher.

Balancing Work and Life as a Remote Instructor

Setting up a workspace that you can call your own is key. Find a spot in your home where you can shut out distractions. This doesn’t mean you need a fancy office; even a small desk in the corner can work wonders. Make sure it’s comfortable and has everything you need at arm’s reach. A good chair, decent lighting, and maybe a plant or two can make a big difference.

Sticking to a schedule is crucial. When your home is your office, the lines can blur easily. Decide on your working hours and be firm about them. Let your family or roommates know when you’ll be “at work” so they respect your time. It’s all about finding that sweet spot where work and personal life don’t overlap too much.

Even though you’re not in a physical classroom, staying in touch with your students is important. Regular check-ins, whether through emails or video calls, can keep everyone on the same page. Encourage open communication so students feel comfortable reaching out. This not only helps them but also keeps you in the loop about their progress and challenges.

Working remotely can sometimes feel like a juggling act, but with the right setup and mindset, you can find a balance that works for you. Remember, it’s not just about managing your time, but also about creating an environment that supports your teaching style and personal life.

Future Trends in Remote Online Instructor Jobs

Embracing New Technologies

The online teaching world is buzzing with new tech! Imagine teaching a class where students can interact in a virtual reality setting or getting help from AI-driven tools that can personalize learning for each student. These technologies are not just futuristic concepts; they’re becoming part of everyday teaching. Incorporating these tools can make lessons more engaging and interactive, helping students learn better.

Growing Demand for Specialized Courses

As more people look to acquire specific skills, there’s a rising demand for specialized online courses. Whether it’s learning a new language, mastering coding, or diving into digital marketing, the opportunities are endless. People are eager to learn skills that can give them a competitive edge in the job market. This means instructors who can offer niche courses are in high demand.

Opportunities in Corporate Training

Companies are investing heavily in employee training, and a lot of it is happening online. With the shift to remote work, businesses are seeking online instructors to help upskill their teams. This opens up a huge market for educators who can tailor courses to meet corporate needs. Corporate training is becoming a significant part of the online education landscape, offering instructors a chance to work with diverse industries and professionals.

The future of online teaching is bright and full of possibilities. As technology advances and the demand for specialized knowledge grows, online instructors will find more opportunities to innovate and inspire. Stay curious and adaptable, and you’ll thrive in this evolving field.

Best Insider Tips & Hacks for Online Teaching Success

Stepping into the world of online teaching can feel overwhelming at first, but with a few insider tips and hacks, you can elevate your teaching game and create a seamless learning experience. Here’s a guide to help you teach like a pro:

1. Optimize Your Workspace for Productivity

- Lighting Matters: Good lighting is crucial for on-camera teaching. Use natural light or a ring light to ensure your face is well-lit.

- Backgrounds Count: A clean, clutter-free background gives a professional impression. Consider using a virtual background or branding your teaching space.

- Tech Check: Always test your internet speed, camera, and microphone before each session to avoid disruptions.

2. Keep Students Engaged

- Gamify Learning: Use platforms like Kahoot! or Quizizz to create fun quizzes and activities.

- Interactive Breaks: Incorporate short polls or live Q&A sessions to keep students involved.

- Personal Touch: Start each class with a quick icebreaker or greeting to build rapport and a sense of community.

3. Time Management Tricks

- Use Timers: Tools like online timers can help manage activities during sessions, keeping lessons on track.

- Batch Record Lectures: Record and edit your content in batches for efficiency.

- Plan Breaks: Schedule short breaks in longer classes to prevent burnout—for both you and your students.

4. Tech Hacks to Save Time and Enhance Learning

- Keyboard Shortcuts: Learn shortcuts for tools like Zoom, Google Classroom, or Microsoft Teams to streamline your workflow.

- Auto-Transcription Tools: Use tools like Otter.ai or Descript to transcribe lessons for students who prefer written resources.

- Pre-Set Templates: Tools like Canva and Google Slides offer customizable templates for creating lesson plans, presentations, and worksheets quickly.

5. Build Strong Connections with Students

- Office Hours: Offer dedicated times for one-on-one check-ins with students. This shows you care about their progress.

- Celebrate Milestones: Acknowledge achievements, such as completing a module or showing improvement, to keep motivation high.

- Feedback Loop: Regularly ask students for feedback on what’s working and adjust your methods accordingly.

6. Make the Most of Online Tools

- Breakout Rooms: Platforms like Zoom allow breakout rooms for small group discussions or projects.

- Collaborative Tools: Use Google Docs, Padlet, or Miro for interactive, group-based tasks.

- Screen Annotation: Tools like Kami or built-in Zoom features let you annotate shared screens for real-time learning enhancement.

7. Stay Organized and Avoid Burnout

- Digital Calendars: Use tools like Google Calendar to plan your schedule and set reminders for classes and deadlines.

- Use Automation: Automate routine tasks like attendance tracking or grading with tools like Classcraft or Google Sheets formulas.

- Set Boundaries: Define work hours and stick to them. Log off at the end of your teaching day to recharge.

8. Market Yourself Like a Pro

- Social Proof: Ask for testimonials from satisfied students and display them on your website or profile.

- Leverage Referrals: Offer incentives for students who refer friends or family to your classes.

- Stay Active Online: Engage with educators on LinkedIn or post your teaching highlights on social media to attract more opportunities.

With these tips and hacks, you’ll not only streamline your teaching process but also create an enjoyable and effective learning environment for your students. Remember, small tweaks can lead to big improvements! Experiment with these strategies and discover what works best for you.

More Info, Resources & Recommended Books

If you’re ready to deepen your knowledge and sharpen your skills as an online instructor, there are plenty of resources available to guide you. From books to online tools, here’s a curated list to help you on your journey:

Books to Inspire and Educate

- “The Online Teaching Survival Guide” by Judith V. Boettcher and Rita-Marie Conrad

- A practical book offering strategies for creating engaging online courses, handling challenges, and mastering virtual teaching techniques.

- “E-Learning and the Science of Instruction” by Ruth C. Clark and Richard E. Mayer

- This book combines proven learning theories with practical advice to design effective online instruction.

- “Teach Online: Design Your First Online Course” by Angela McMillan

- A beginner-friendly guide that walks you through designing and launching your first online course.

- “Flip Your Classroom: Reach Every Student in Every Class Every Day” by Jonathan Bergmann and Aaron Sams

- A revolutionary approach to modern teaching, this book is perfect for understanding flipped learning and making online teaching more interactive.

- “Design for How People Learn” by Julie Dirksen

- A must-read for understanding the psychology of learning and applying it to online teaching.

Online Courses and Webinars

- Coursera: Offers specialized certifications in online teaching and learning, such as the “Foundations of Virtual Instruction” course.

- EdX: Explore courses like “Online Learning Design and Delivery” from top universities.

- LinkedIn Learning: A treasure trove of short courses on virtual communication, instructional design, and teaching strategies.

- ISTE (International Society for Technology in Education): Provides webinars, articles, and training tailored for educators embracing technology.

Blogs and Websites

- TeachThought – Regular updates on modern teaching strategies and trends in online education.

- EdSurge – Focuses on the intersection of technology and education, offering insights into edtech tools.

- KQED MindShift – Covers the latest in education innovation, including online and remote teaching strategies.

Free Tools and Resources for Educators

- Khan Academy: Offers free lessons, resources, and tools for teachers to use in their virtual classrooms.

- Google for Education: A suite of free tools including Google Classroom, Google Meet, and collaborative apps for teaching.

- Open Educational Resources (OER): A vast library of free materials and open textbooks for educators.

- Canva for Education: Provides free access to templates and design tools tailored for teachers.

Learning to teach effectively online is a continuous journey, and these resources are here to support you every step of the way. Start by picking one or two books or online courses, and gradually integrate what you learn into your teaching practice.

With the right knowledge and tools, you’ll not only enhance your teaching skills but also make a meaningful impact on your students’ learning experiences.

Success Stories: Inspiring Online Instructors

Let’s dive into some inspiring stories of online educators who’ve made a mark in the digital teaching world. These folks have turned their teaching passion into thriving ventures.

- Lessons By Brooke & Company: This business has taken off, pulling in an impressive $540K annually. Their approach is all about personalized learning, which has resonated well with students.

- Teacher Jade’s Writing Academy: With a focus on creative writing, Jade’s academy earns about $144K a year. Her secret? Engaging storytelling techniques that capture students’ imaginations.

- Notary Training Network: This niche training program brings in $54K annually, proving that specialized courses can indeed be lucrative.

- Fem ‘n STEM: A platform dedicated to encouraging women in STEM fields, earning $18K annually. It’s a testament to the growing demand for diversity-focused education.

These educators have shared some nuggets of wisdom from their journeys:

- Adaptability is Key: Being open to changing your teaching methods to fit the needs of your students can make a huge difference.

- Continuous Learning: Keep updating your skills. The world of online teaching evolves fast, and staying updated is crucial.

- Building Connections: Forming genuine relationships with your students can boost engagement and success.

Thinking about jumping into online teaching? Here are a few tips:

- Start Small: Don’t overwhelm yourself. Begin with a few students and gradually expand.

- Embrace Technology: Get comfortable with the tools that can enhance your teaching experience.

- Stay Passionate: Your enthusiasm can be contagious. If you love what you do, your students will too.

Teaching online has opened doors I never imagined. Watching my students grow and succeed is incredibly rewarding.

These stories show that with dedication and the right mindset, anyone can succeed in the online teaching space.

Wrapping Up: The Bright Future of Online Teaching

So, there you have it! The world of online teaching is buzzing with possibilities, especially as we move into 2024. Whether you’re a seasoned educator or just dipping your toes into the teaching pool, there’s a spot for you in this ever-growing field. The best part? You can do it all from the comfort of your home, in your favorite pajamas, with a cup of coffee in hand. It’s not just about teaching; it’s about connecting with students from all over the globe and making a real impact. So, if you’re thinking about jumping into this exciting world, now’s the time. The future is bright, and who knows where this journey might take you? Go ahead, explore your options, and embrace the adventure!

Frequently Asked Questions

What are online instructor jobs?

Online instructor jobs involve teaching students over the internet. You can teach various subjects, helping students learn from home.

Do I need special qualifications to become an online instructor?

While some platforms may require teaching degrees or certifications, many only need you to be knowledgeable in your subject.

How can I find online instructor jobs?

You can search on job websites, education platforms, or even social media. Many companies are looking for online instructors.

What subjects are in high demand for online teaching?

Subjects like math, science, and English are popular. However, you can also teach skills like coding or art.

Can I work as an online instructor part-time?

Yes! Many online instructor jobs offer flexible hours, allowing you to work part-time if you prefer.

What tools do I need to teach online?

You’ll need a computer and a reliable internet connection. Some platforms also provide tools for video calls and classroom management.

Best Online WFH Jobs: Your Guide to Remote Work Opportunities in 2024 and Beyond

If you are asking yourself what are the best online WFH jobs, this article will give you a full guide.

As a side hustler, I understand the challenges of breaking into a new industry, especially one as flexible and sought-after as the world of Work-From-Home (WFH) jobs. When I started my side hustle journey, I faced numerous barriers—not only was I a beginner, but I also wasn’t a native English speaker. I had to carve out my own path. However, with determination and the right strategies, I was able to learn the necessary skills to succeed. If I could do it, you can successfully transition into a rewarding WFH career too.

The WFH space offers a vast array of opportunities, from freelance writing to virtual assistance, project management, and beyond. It’s a field where flexibility and innovation meet, providing options for anyone willing to adapt and grow. By choosing a WFH job, you’re not just creating a source of income—you’re building a lifestyle that aligns with your goals and priorities.

If you already have these valuable, transferable skills, you’re in a strong position to excel in a WFH role:

- Problem-solving: Side hustling often requires finding creative solutions to unexpected challenges.

- Time management: Juggling multiple tasks and deadlines is a common side hustle skill.

- Self-discipline: The ability to work independently and stay motivated is crucial.

- Adaptability: Side hustlers often need to pivot quickly to meet market trends and client demands.

When I started as a side hustler, I had no experience in traditional jobs or corporate careers. My journey began in the gig economy because my language barrier made it difficult to pursue conventional roles. Moving to New York in my 20s without speaking a word of English was daunting, but I learned quickly. Over time, I developed skills that allowed me to thrive in the side hustle world and eventually transition into remote work opportunities.

Looking back, one of the most valuable lessons I learned is this: if I could start over, I’d focus on finding a high-paying WFH job as a way to generate income while investing in personal growth. Specifically, I would use that income to learn from a mentor who could guide me through building a successful online business. By combining practical WFH experience with expert mentorship in order to build my online business, I believe I could have accelerated my path to financial independence and personal fulfillment.

By leveraging your determination, resourcefulness, and skills, you can create a fulfilling and flexible online business that fits your lifestyle and this is how I scaled from side hustler to successful online entrepreneur and today I am financially independent!

However in uncertain economic times, finding stability can feel overwhelming and that is why WFH jobs stand out as a solution, offering flexibility, resilience, and opportunities even for those without extensive experience.

Many entry-level remote roles are designed to welcome newcomers, offering training and support to help you thrive. From virtual customer support to social media management and entry-level project coordination, these jobs not only withstand economic challenges but also pave the way for long-term growth.

Exploring the top WFH opportunities today can set you on a path to financial security and personal fulfillment, all while enjoying the flexibility of working from home.

Working from home has really become a big deal, especially with more companies offering online wfh jobs and if you’re looking to switch things up in 2024 and beyond, remote work might be your ticket.

This guide will help you explore different job roles, the perks of working from home, and how to kickstart your remote career. Whether you’re a newbie or a seasoned pro, there’s something out there for everyone.

Key Takeaways

- Remote jobs offer flexibility and the chance to work from anywhere.

- There are roles for all skill levels, from customer service to tech jobs.

- Freelancing can be a great way to be your own boss while working remotely.

- Balancing work and life is crucial for remote job success.

- Networking and online job boards are essential for finding remote opportunities.

Who Should Read This Article?

This article is for anyone who is:

- Considering a career change: If you’re looking for more flexibility and work-life balance, remote work could be the answer.

- Seeking new career opportunities: Whether you’re a recent graduate, a seasoned professional, or looking to re-enter the workforce, remote work offers a wide range of options.

- Interested in entrepreneurship: If you’re considering freelancing or starting your own business, this article provides valuable insights into the world of remote work.

- Curious about the future of work: Remote work is transforming the job market. This article provides a glimpse into the evolving world of work and how to navigate it successfully.

Essentially, if you’re interested in learning more about the benefits of remote work, exploring different career paths, and discovering how to thrive in a flexible work environment, this article is for you.

Exploring Exciting Online WFH Jobs

Diverse Roles for Every Skill Set

Working from home is more than just a trend—it’s a lifestyle. Whether you’re a tech wizard, a creative soul, or someone who thrives on helping others, there’s a remote job out there for you. Imagine finding a job that fits your skills perfectly and lets you work in your pajamas! From remote social media manager to freelance copywriter, the opportunities are endless. You can dive into roles like virtual assistant, data analyst, or even online therapist. The key is to match your skills with the right job.

Benefits of Working Remotely

The perks of working remotely are hard to ignore. For starters, you can say goodbye to the daily commute, saving both time and money. Plus, there’s the flexibility to create a schedule that suits your lifestyle. This means more time for family, hobbies, or even that morning yoga class. Working remotely also often leads to increased productivity and job satisfaction, as you can design a workspace that truly works for you.

How to Get Started

Getting started with remote work might seem daunting, but it doesn’t have to be. Here’s a simple plan to kick things off:

- Identify Your Skills: Make a list of what you’re good at and what you enjoy doing.

- Research Opportunities: Look for jobs that match your skills. Websites specializing in remote work can be a great resource.

- Tailor Your Resume: Highlight your skills and experiences that are most relevant to remote work.

- Prepare for Interviews: Practice your video interview skills and make sure your tech setup is reliable.

“Starting a remote job is like opening a new chapter in your life—full of potential and freedom. Embrace it and see where it takes you!”

Unlocking Flexible Work Opportunities

Part-Time vs Full-Time Positions

When you think about flexible work, the choice between part-time and full-time gigs is a big deal. Part-time roles are perfect if you want to balance work with other commitments like school or family. They typically offer fewer hours, giving you more freedom to manage your time. On the other hand, full-time positions provide more stability and benefits, like health insurance and paid time off. It’s all about what suits your lifestyle best.

Freelancing: Your Own Boss

Freelancing is like the wild west of work. You set your own hours, choose your projects, and basically, you’re your own boss. It’s a fantastic way to turn your skills into cash, whether you’re a writer, designer, or coder. However, freelancing comes with its own set of challenges, like finding clients and managing your finances. But if you love flexibility and variety, this could be your dream setup.

Finding the Right Fit for You

Finding the right job isn’t just about the paycheck. It’s about what fits your lifestyle and goals. Start by listing what you need from a job—flexible hours, remote work, or a creative outlet. Then, explore different roles and industries to see what matches your criteria. Networking and job boards can be your best friends here. Remember, the right job should feel like a good pair of shoes—comfortable and supportive.

“In the world of flexible work, it’s not just about earning a living; it’s about living while you earn.”

Consider insights from Remote’s Global Workforce Report to understand how international hiring and flexible work are shaping the job market today. This can help you make informed decisions about your career path.

Thriving in Remote Customer Service Roles

Working in remote customer service isn’t just about answering calls or emails. It’s about connecting with people, understanding their needs, and solving their problems. Strong communication skills are a must. You need to be clear, concise, and above all, friendly. Being tech-savvy is also a big plus, as you’ll likely use various digital tools to stay connected with your team and customers. Another important skill is time management. Balancing multiple tasks and staying organized ensures you meet customer needs promptly.

Balancing Work and Life

Finding a balance between work and personal life can be tricky when your office is your home. Here are some tips:

- Set clear boundaries: Define your work hours and stick to them. This helps in avoiding burnout.

- Take breaks: Regular short breaks can help you recharge and stay focused.

- Stay connected: Schedule time to chat with friends or family to maintain social connections.

“Working from home often allows you to plan your work around life, rather than your life around your work.”

Navigating Job Applications

Landing a remote customer service role starts with a standout application. Highlight any experience with remote work, even if it’s informal. Employers look for candidates who are self-motivated and can work independently. Tailor your resume to showcase relevant skills like problem-solving and adaptability. During interviews, make sure your tech setup is solid. Test your internet connection, camera, and microphone beforehand to avoid any hiccups. Remember, first impressions matter, even if they’re virtual.

The Rise of Data Entry Jobs

What to Expect in Data Entry

Data entry jobs have come a long way and are now a staple in the remote work world. These roles are perfect for those who want to work from home without the need for advanced skills. Generally, they involve inputting information into systems, maintaining records, and ensuring data accuracy. The tasks might sound repetitive, but they offer a great way to earn money while enjoying the comfort of your own home.

Getting Started with No Experience

Starting a career in data entry is easier than you might think, especially if you’re new to the job market. Here are a few steps to kick off your journey:

- Brush Up on Typing Skills: Fast and accurate typing is essential. There are plenty of free online tools to help you practice.

- Learn Basic Software: Familiarize yourself with spreadsheet software like Excel or Google Sheets.

- Create a Simple Resume: Highlight any relevant skills, like attention to detail and reliability.

Tips for Success in Data Entry

To thrive in data entry, you need more than just quick fingers. Here are some tips to help you succeed:

- Stay Organized: Keep your files and workspace tidy to avoid confusion.

- Double-Check Your Work: Accuracy is key, so always review your entries.

- Set a Routine: Having a consistent work schedule can boost productivity.

With over 60% of Data Entry Specialists now working remotely, this trend is expected to continue growing, offering more opportunities for those looking to work from home. Remote work is increasingly common, with over 60% of Data Entry Specialists working remotely, a trend that has been steadily rising over the past two years.

Data entry jobs are not just about punching numbers; they offer a chance to work flexibly and be part of the digital transformation that many companies are embracing today.

Creative Online Tutoring Opportunities

Subjects in Demand

Online tutoring is a booming field with a wide array of subjects in high demand. If you’re passionate about teaching, you can find opportunities in areas like math, science, languages, and even arts. The beauty of online tutoring is that it caters to a broad audience, from school kids needing extra help to adults learning a new skill. Math and science remain top choices, but don’t overlook the growing interest in creative subjects like music and art.

Setting Your Own Schedule

One of the biggest perks of online tutoring is the flexibility it offers. You can set your own hours, which is perfect if you have other commitments or just prefer working at odd times. This flexibility allows you to balance work with personal life effectively. Imagine sipping your morning coffee while preparing for a tutoring session scheduled at your convenience.

Building a Student Base

Starting as an online tutor might seem daunting, but building a student base is easier than you think. Begin by identifying your strengths and the subjects you’re most comfortable with. Sign up on platforms that connect tutors with students, such as those found in a curated list of companies offering online tutoring jobs. Create a compelling profile highlighting your skills and experience. Engage with your students, gather feedback, and use it to improve your sessions. Word of mouth and positive reviews can significantly boost your visibility and attract more students.

Teaching online not only allows you to earn money but also gives you the satisfaction of making a difference in someone’s learning journey. Whether you’re helping a student grasp complex concepts or assisting them in exploring new hobbies, the impact you have as a tutor is profound.

By diving into the world of online tutoring, you’re not just teaching; you’re crafting a unique learning experience that can inspire and educate people from all walks of life.

Tech-Savvy Remote Work Options

In-Demand Tech Roles

If you’re tech-savvy and looking to work remotely, there are plenty of roles to consider. Software development, data analysis, and cybersecurity are just a few of the hot fields right now. Companies are always on the hunt for skilled professionals who can tackle complex problems from anywhere in the world. The demand for tech roles is booming, thanks to the ever-growing reliance on digital solutions.

Essential Skills for Tech Jobs

To succeed in these roles, you’ll need a strong grasp of programming languages, data management, and network security. But don’t worry if you’re not an expert yet; there are tons of resources online to help you upskill. Consider diving into coding bootcamps or online courses to sharpen your skills. Being adaptable and ready to learn is key.

Resources for Tech Job Seekers

Finding the right job can be daunting, but there are resources to help. Job boards like Remote.co and We Work Remotely list numerous tech positions. Networking is also crucial—join online communities or forums where you can connect with other tech professionals. Remember, persistence is vital, so keep applying and refining your skills.

Success Stories from Remote Workers

Many folks have completely turned their lives around by embracing remote work. Take Sarah, for instance. She was once tied to a desk job she didn’t love. Now, she’s thriving as a digital marketer, working from her cozy home office or sometimes even from a beachside café. Her story is a testament to how remote work can transform not just your career, but your entire lifestyle.

Starting remote work can be a bit of a rollercoaster. John, a software developer, initially struggled with distractions at home. But he quickly learned the importance of setting up a dedicated workspace and sticking to a schedule. These changes helped him not only get his work done but also enjoy the flexibility that remote work offers. Here are some nuggets of wisdom he shared:

- Stay organized: Utilize tools like calendars and to-do lists to keep on top of tasks.

- Communicate effectively: Regular check-ins with your team via video calls or chats are crucial.

- Set clear boundaries: It’s important to separate work time from personal time to avoid burnout.

“Remote work isn’t just a job, it’s a lifestyle that gives you the freedom to live the way you want,” says Emma, a successful freelance writer.

If you’re new to the remote work scene, here are some tips from those who’ve been there:

- Find your rhythm: Everyone’s most productive at different times. Identify when you’re at your best and plan your work around it.

- Embrace technology: Get comfortable with digital tools that facilitate remote work, like project management software and communication apps.

- Stay connected: Remote work can be isolating, so make an effort to connect with colleagues and other professionals in your field.

These inspiring success stories remind us that with determination and the right approach, remote work can lead to a fulfilling and balanced life.

Expert and Insider Tips & Hacks

- Embrace the Power of Communication: Over-communicate with your team. Utilize video calls, instant messaging, and project management tools to stay connected and ensure everyone is on the same page.

- Create a Dedicated Workspace: Even if it’s just a corner of your room, designate a specific area for work. This helps you mentally switch gears and maintain focus.

- Utilize the Pomodoro Technique: This time-management method involves working in 25-minute intervals with short breaks in between. It can help you stay focused and avoid burnout.

- Invest in Ergonomic Office Equipment: A comfortable chair, a good desk, and a quality monitor can significantly improve your comfort and productivity while working from home.

- Take Advantage of Online Communities: Join online forums and groups related to remote work. Connect with other remote professionals, share experiences, and learn from their successes and challenges.

- Don’t Neglect Your Mental Health: Working from home can sometimes feel isolating. Schedule regular breaks, prioritize self-care activities, and maintain social connections.

- Continuously Upskill: The world of work is constantly evolving. Invest in your professional development by taking online courses, attending webinars, or pursuing certifications to stay competitive.

By incorporating these expert tips and insider hacks into your remote work routine, you can increase your productivity, improve your work-life balance, and build a successful and fulfilling career from anywhere.

More Information, Resources, and Recommended Books & Audiobooks

For further exploration and in-depth knowledge, consider these resources:

- Books:

- “Remote: Office Not Required” by Jason Fried and David Heinemeier Hansson: A classic for remote work enthusiasts, this book delves into the realities and benefits of building a distributed company.

- “The 4-Hour Workweek” by Timothy Ferriss: While not solely focused on remote work, this book offers valuable insights on optimizing productivity, automating tasks, and achieving location independence.

- Audiobooks:

- “Indistractable: How to Control Your Attention and Choose Your Life” by Nir Eyal: This audiobook provides valuable strategies for overcoming distractions and reclaiming focus, essential skills for successful remote work.

- “Deep Work: Rules for Focused Success in a Distracted World” by Cal Newport: This audiobook explores the importance of deep work – focused, uninterrupted work – in a world of constant distractions, a critical skill for remote professionals.

- “Digital Nomad Manifesto: Unlock Health, Wealth, and Love While Exploring the Globe” by Alex Berman

You can find these and other relevant books and audiobooks on Amazon by searching for their titles or by exploring categories like “Remote Work,” “Digital Nomadism,” “Productivity,” and “Personal Development.”

Wrapping Up: Your Remote Work Adventure Awaits

So, there you have it! The world of remote work is bursting with opportunities just waiting for you to dive in. Whether you’re looking to start fresh or make a career switch, there’s something out there that fits your lifestyle and skills. Working from home isn’t just a trend—it’s a new way of life that offers flexibility and freedom. So why not take the plunge? Your dream job might be just a click away. Remember, every great journey starts with a single step, so go ahead and explore the possibilities. The future of work is here, and it’s remote!

Frequently Asked Questions

What are the perks of working from home?

Working from home lets you set your own schedule and work from anywhere, making it easier to balance your job and personal life.

How can I start a remote job with no experience?

Look for entry-level positions like data entry or customer service. Many companies offer training, so you can learn as you go.

Are there full-time remote jobs available?

Yes, there are plenty of full-time remote jobs in various fields like tech, writing, and customer support.

How do I avoid scams when searching for remote jobs?

Use trusted job boards and research companies before applying. Avoid jobs that ask for upfront payments or personal information.

What skills are needed for remote work?

Good communication, time management, and tech skills are important for remote work success.

Can I work remotely in a tech job without a degree?

Yes, many tech jobs value skills and experience over formal education. Online courses and certifications can help you get started.

Your Next Steps – Where to Go From Here

Now that you’re equipped with this information, it’s time to take action!

- Assess your skills and interests: Identify your strengths and passions, and consider how they translate into remote work opportunities.

- Start your job search: Explore job boards, network with other professionals, and tailor your resume and cover letter for remote positions.

- Experiment and find what works for you: Try different remote work strategies, experiment with your schedule, and find what makes you most productive and fulfilled.

- Embrace the journey: Remote work is an ongoing learning experience. Be patient with yourself, embrace new challenges, and celebrate your successes along the way.

- Prioritize and Stay Financially Focused: Avoid Shiny Object Syndrome: A common pitfall is Shiny Object Syndrome. This is the tendency to chase the latest trends or opportunities without a clear financial goal. Instead of constantly seeking the next big thing, focus on building a solid foundation and growing your wealth.

To avoid Shiny Object Syndrome, consider the following:

- Set Clear Financial Goals: Define specific, measurable, achievable, relevant, and time-bound (SMART) financial goals.

- Create a Budget: Develop a realistic budget that outlines your income and expenses.

- Invest Wisely: Explore investment options like stocks, bonds, or real estate to grow your wealth over time.

- Avoid Impulse Spending: Resist the urge to splurge on unnecessary purchases.

- Continuously Review and Adjust: Regularly assess your financial situation and make adjustments as needed.

By staying focused on your financial goals and avoiding distractions, you can achieve long-term financial security.

The future of work is flexible, and remote work with a wfh job offers a pathway to a more fulfilling and balanced life. By taking these steps and embracing the opportunities that remote work presents, you can unlock your full potential and achieve your career goals.

Related Articles:

Home Remote Jobs with No Degree Requirements

Top 10 Recession-Proof Jobs to Secure Your Future

Top 10 Recession Proof IT Jobs with No Experience to Secure Your Future in 2024

Top 10 Recession Proof IT Jobs with No Experience to Secure Your Future in 2024

What is a recession proof IT job with no experince and how to secure your future with one of these recession proof it jobs? This article will explore all of these questions for you and give you all the answers you need in order to chose the best recession proof it job for your situation.

As a side hustler, I understand the challenges of breaking into a new industry, especially one as dynamic and ever-evolving as IT. As a beginner when I started my side hustle I faced so many barriers barriers because I am not even an English native speaker and I had to carve my own path. However, with determination and the right approach I was able to learn the neccessary skills needed. If I was able to do it as a non English native speaker, you can successfully transition into an IT career, too.

The IT industry offers a plethora of opportunities, from software development to cybersecurity. It’s a field where innovation thrives, and the demand for skilled professionals is consistently high. By choosing an IT career, you’re not just securing a job, but you’re investing in a future-proof skillset.

If you are already equipped with the following valuable skills that can be transferred to an IT career you are golden:

- Problem-solving: Side hustling often requires creative solutions to unexpected challenges.

- Time management: Juggling multiple tasks and deadlines is a common side hustle skill.

- Self-discipline: The ability to work independently and stay motivated is crucial.

- Adaptability: Side hustlers often need to adapt to changing market trends and customer demands.

I do not have any experience with a real job or career at a company let alone a job in the IT field because right from the start I went straight into the gig economy as a side hustler because of my language barrier. I moved to New York in my 20s and did not speak one word English, but I learned quickly and from a very early age I got into the world of side hustling.

Drawing from my personal experiences as a side hustler, I’ve learned valuable lessons that can help newcomers navigate their IT journey more efficiently. By avoiding common pitfalls and leveraging proven strategies, you can save time, reduce stress, and accelerate your career growth.

Today, I can share a valuable lesson I’ve learned from my years as a side hustler. If I could start over, I’d apply for a high-paying remote IT job to generate income. I’d then invest that money into learning from a mentor who could guide me through the process of building a successful online business. By combining practical experience with expert mentorship, I believe I could accelerate my journey to financial independence and fulfillment.

If you’re ready to take your IT career to the next level, consider investing in a mentor. A mentor can provide guidance, support, and accountability as you navigate your journey. They can share valuable insights, help you overcome challenges, and connect you with industry professionals.

Remember, your side hustle experience has prepared you well for a successful IT career. By leveraging your skills, knowledge, and determination, you can achieve your goals and make a significant impact in the IT industry.

In uncertain economic times, finding a stable career can feel daunting. The IT sector stands out as a beacon of resilience, offering numerous opportunities even for those without prior experience.

Many entry-level IT roles are designed to welcome newcomers, providing the training and support needed to thrive. From helpdesk support to junior developer positions, these jobs not only withstand recessions but also pave the way for long-term career growth.

Exploring these top 10 recession-proof IT jobs can set you on a path to financial security and professional fulfillment, all without needing a hefty resume to start.

Key Takeaways

- IT Sector Resilience: The IT industry remains robust during economic downturns, offering stable career opportunities even without prior experience.

- Diverse Entry-Level Roles: Positions like Help Desk Support, Junior Web Developer, and IT Support Specialist provide accessible pathways into the IT field.

- Essential Certifications: Obtaining certifications such as CompTIA A+ or Cisco’s CCNA can significantly enhance job prospects and foundational knowledge.

- High Demand for Technical Support: With the rise of remote work and digital transformation, roles in technical support and cloud services are increasingly essential.

- Job Security and Growth: Recession-proof IT jobs not only offer stability but also opportunities for long-term career advancement and professional fulfillment.

- Continuous Learning Opportunities: The dynamic nature of IT encourages ongoing skill development, ensuring professionals remain relevant and adaptable.

Who Should Read This?

This article is primarily targeted at individuals who are:

- Considering a career in IT: This article can help you understand the various roles available, their potential, and the steps to get started.

- Early-career IT professionals: The information can guide you in career progression, specialization, and skill development.

- Job seekers: This article can help you identify in-demand IT roles and the skills and certifications required to land a job.

- Career changers: If you’re considering a career switch to IT, this article can provide insights into the necessary skills and certifications.

- Students and recent graduates: This article can help you make informed decisions about your IT education and career path.

Ultimately, anyone interested in the IT industry, regardless of their current experience level, can benefit from the information provided in this article.

Recession Proof IT Job 1: Help Desk Support Technician

Starting a career as a Help Desk Support Technician is an excellent entry point into the IT industry. This role equips individuals with essential technical skills and customer service experience.

Job Overview

A Help Desk Support Technician assists users with technical issues related to hardware, software, and network systems. They resolve problems through phone, email, or in-person interactions, ensuring minimal downtime for businesses. Daily tasks include troubleshooting software glitches, setting up new equipment, and maintaining user accounts. Technicians often use ticketing systems to manage and prioritize support requests efficiently. Additionally, they document solutions to common problems, creating a knowledge base for future reference. This role requires strong communication skills, patience, and a basic understanding of IT systems. Many companies offer on-the-job training, making it accessible for those with no prior experience. Certifications like CompTIA A+ can enhance job prospects and provide foundational knowledge. Help Desk Technicians play a crucial role in maintaining the smooth operation of an organization’s IT infrastructure, making them indispensable team members.

Why It’s Recession Proof

Help Desk Support Technician positions remain stable during economic downturns because businesses still need to maintain their IT systems. Even in tough times, organizations rely on technology for daily operations, requiring constant technical support. This demand ensures that Help Desk roles are less susceptible to layoffs compared to other positions. Additionally, as companies strive to cut costs, having an in-house support team becomes more valuable than outsourcing. The essential nature of troubleshooting and maintaining IT infrastructure means that Help Desk Technicians are always needed to solve urgent technical issues. Furthermore, the rise of remote work increases the need for reliable technical support, reinforcing job security. With the continuous evolution of technology, the skills acquired in this role remain relevant, offering long-term career stability. As a result, Help Desk Support Technicians enjoy consistent employment opportunities, even in uncertain economic climates.

Popular Help Desk Support Technician Jobs

Here are some popular job titles you might encounter within the realm of Help Desk Support Technician roles:

- Tier 1 Technical Support Specialist: Often the first point of contact for users, these technicians handle basic troubleshooting and provide initial support.

- Tier 2 Technical Support Specialist: These technicians handle more complex issues that require deeper technical knowledge and problem-solving skills.

- Desktop Support Technician: These professionals focus on supporting end-user devices like desktops, laptops, and mobile devices.

- Field Service Technician: These technicians provide on-site support to resolve hardware and software issues at various locations.

- Remote Support Technician: These technicians work remotely to assist users with technical issues over the phone, email, or remote desktop tools.

By understanding the nuances of these roles, you can tailor your skills and experiences to target specific job opportunities within the Help Desk Support Technician field.

Help Desk Support Technician Salary Insights

The salary for a Help Desk Support Technician can vary depending on several factors, including:

- Experience: More experienced technicians typically command higher salaries.

- Location: Salaries can vary significantly depending on the geographic location. Metropolitan areas tend to offer higher salaries compared to rural areas.

- Company Size and Industry: Larger companies and industries with higher profit margins may offer higher salaries.

- Certifications: Possessing industry certifications, such as CompTIA A+, can increase earning potential.

General Salary Range:

While salaries can fluctuate, a general salary range for a Help Desk Support Technician can be anywhere between $30,000 to $50,000 annually in the United States. However, with experience, certifications, and specialized skills, this range can extend to higher figures.

To get a more accurate salary estimate for your specific location and experience level, consider using online salary calculators or consulting with job boards and recruitment agencies.

Importance of Specific Certifications

While certifications aren’t strictly necessary for entry-level Help Desk positions, they can significantly boost your career prospects and earning potential. Some relevant certifications include:

- CompTIA A+: This certification validates foundational knowledge in PC hardware and software troubleshooting. It’s a great starting point for aspiring IT professionals and can open doors to various IT support roles.

- Microsoft Certified: Fundamentals (various certifications): These certifications validate basic knowledge of Microsoft technologies, including Windows operating systems, Office applications, and Azure. They can be particularly beneficial for those working in environments that heavily rely on Microsoft products.

Future Trends Impacting Help Desk Support Technicians

The role of a Help Desk Support Technician is constantly evolving due to technological advancements. Some key trends that will shape the future of this role include:

- AI and Automation: AI-powered chatbots and automated ticketing systems can streamline routine tasks, allowing technicians to focus on more complex issues.

- Remote Work and Digital Transformation: As remote work becomes more prevalent, the demand for efficient remote support solutions will increase.

- Cybersecurity: With the increasing threat of cyberattacks, Help Desk Technicians may need to acquire knowledge of basic cybersecurity principles to identify and report potential threats.

- Cloud Computing: As more organizations adopt cloud-based solutions, Help Desk Technicians may need to gain expertise in cloud technologies like AWS, Azure, or Google Cloud.

By staying updated with these trends and acquiring relevant certifications, Help Desk Support Technicians can position themselves for long-term career growth and success.

Recession Proof IT Job 2: Junior Web Developer

Starting a career as a Junior Web Developer offers a solid entry point into the IT industry, even for those without prior experience.

Job Overview

A Junior Web Developer designs, builds, and maintains websites under the guidance of senior developers. Responsibilities include writing clean and efficient code, troubleshooting website issues, and ensuring sites are responsive and user-friendly. They often work with languages like HTML, CSS, JavaScript, and frameworks such as React or Angular. Collaborating with designers and other team members is essential to create cohesive and functional web applications. Junior Web Developers also participate in testing and deploying websites, ensuring they meet performance standards and are optimized for search engines. Many positions offer on-the-job training, allowing individuals to learn and grow within the role. Additionally, the demand for web developers spans various industries, providing diverse opportunities to specialize in areas like e-commerce, healthcare, or education. Entry-level roles typically require a basic understanding of web development principles and a willingness to continuously learn new technologies. Certifications and portfolio projects can enhance a candidate’s prospects, showcasing their skills to potential employers. Overall, the role serves as a foundational step for those aspiring to advance into more specialized or senior development positions.

Why It’s Recession Proof

Websites remain essential for businesses to reach customers, making Junior Web Developers indispensable even during economic downturns. Companies prioritize maintaining and improving their online presence to stay competitive, ensuring a steady demand for web development skills. Unlike some roles that are cut during recessions, web development supports digital transformation initiatives, which often accelerate when businesses seek cost-effective solutions. Additionally, the rise of e-commerce and remote services increases the need for robust, user-friendly websites, further solidifying the role’s stability. Junior Web Developers can adapt to various industries, providing flexibility that enhances job security. The continuous evolution of web technologies also means that skilled developers are always in demand, as businesses seek to stay updated with the latest trends and standards. Furthermore, many organizations invest in developing their internal web capabilities to reduce reliance on external agencies, creating more in-house opportunities. The ability to work remotely also broadens job prospects, allowing developers to find positions in different regions or countries. Overall, the essential nature of web presence and the adaptability of Junior Web Developers make this role highly resilient during recessions.

Popular Junior Web Developer Jobs

Here are some popular job titles you might encounter within the realm of Junior Web Developer roles:

- Front-End Developer: These developers focus on the visual aspects of a website, including the user interface and user experience.

- Back-End Developer: These developers work on the server-side of a website, handling database interactions, server logic, and application programming interfaces (APIs).

- Full-Stack Developer: These developers work on both the front-end and back-end aspects of a website, giving them a comprehensive understanding of web development.

- Web Designer: These professionals combine artistic skills with technical knowledge to create visually appealing and user-friendly websites.

- Web Application Developer: These developers create dynamic web applications that interact with databases and other systems.

By understanding the nuances of these roles, you can tailor your skills and experiences to target specific job opportunities within the Junior Web Developer field.

Junior Web Developer Salary Insights

The salary for a Junior Web Developer can vary depending on several factors, including:

- Experience: While you’re starting as a junior, gaining experience and mastering new skills can lead to significant salary increases.

- Location: Salaries can vary significantly depending on the geographic location. Metropolitan areas tend to offer higher salaries compared to rural areas.

- Company Size and Industry: Larger companies and industries with higher profit margins may offer higher salaries.

- Skillset: Proficiency in popular programming languages like JavaScript, HTML, CSS, and frameworks like React or Angular can impact your earning potential.

- Certifications: While not always mandatory, certifications can enhance your credibility and potentially boost your salary.

General Salary Range: