1040 Form for Dummies: How to Fill Out a 1040 Form Step by Step for Side Hustlers and Freelancers

Who Should Read This?

If you’re a side hustler, freelancer, gig worker, or independent contractor navigating the complexities of taxes, this guide is tailored to simplify Form 1040 and optimize your tax strategy. Whether you’re just starting out or looking to maximize deductions and credits, understanding Form 1040 is essential for managing your finances effectively.

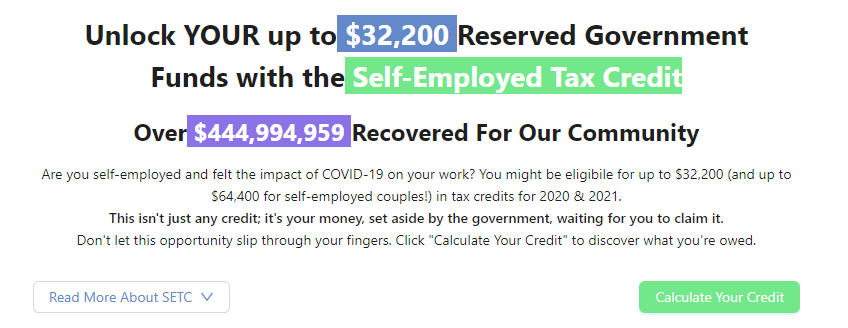

Has Your Self Employed Side Hustle Business Been Hurt by Covid? Then Claim YOUR Money that is set aside and waiting for

self-employed side hustlers just like you! Watch the video below to Unlock your Funds today and get paid in 14 days (no cost involved)! Click here to get started!

Demystifying Form 1040

Navigating taxes can be daunting, especially for side hustlers and freelancers who juggle multiple income streams. Understanding Form 1040 is crucial as it’s the cornerstone of your annual tax filing. This guide aims to simplify Form 1040, helping you optimize your tax strategy and potentially qualify for valuable tax credits like the Self-Employed Tax Credit (SETC).

Understanding Form 1040 Basics

Form 1040 is your key to reporting income and claiming deductions and credits. Whether you’re a freelance writer, gig economy worker, or Etsy entrepreneur, Form 1040 ensures you accurately reflect your earnings and expenses to the IRS. Here’s what you need to know:

Form 1040 consists of several sections:

- Income Reporting: Detail your earnings from all sources, including your side hustle income, freelance gigs, and any other earnings.

- Deductions: Deduct eligible expenses such as business supplies, marketing costs, and home office expenses (if applicable).

- Credits: Explore potential credits like the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC) that can reduce your tax liability.

Navigating Self-Employment Taxes

As a self-employed individual, you’re responsible for paying both income tax and self-employment tax (Social Security and Medicare). Here’s how to manage it:

Self-Employment Tax: Use Schedule SE to calculate and report your self-employment tax. This form ensures you’re contributing to Social Security and Medicare as both employer and employee.

Estimated Tax Payments: To avoid penalties, estimate your quarterly tax payments based on your income projections. Form 1040-ES guides you through this process, helping you stay on top of your tax obligations throughout the year.

Maximizing Deductions and Credits

Deductions and credits are your allies in minimizing taxable income and maximizing your tax refund or reducing your tax liability. Consider these strategies:

Common Deductions: Deduct business-related expenses such as mileage, equipment purchases, and professional services. Keeping meticulous records ensures you capture every eligible expense.

Step-by-Step Guide to Completing Form 1040

Filling out Form 1040 doesn’t have to be intimidating. Follow these steps to navigate the form with confidence:

- Personal Information: Provide accurate personal details, including your Social Security Number and filing status.

- Income Reporting: Report all income sources, ensuring accuracy and completeness.

- Deductions: Itemize deductions or take the standard deduction, whichever benefits you most.

- Tax Credits: Consider credits like the Self-Employed Tax Credit (SETC), EITC, or CTC to reduce your tax liability or increase your refund.

- Review and File: Double-check your entries, attach any required schedules (like Schedule C for business income), and file electronically or by mail.

Has Your Self Employed Side Hustle Business Been Hurt by Covid? Then Claim YOUR Money that is set aside and waiting for

self-employed side hustlers just like you! Click Here to Unlock your Funds today and get paid in 14 days (no cost involved)!

Common Mistakes and How to Prevent Them (Dos and Don’ts)

Avoiding common pitfalls can streamline your tax filing process and maximize your tax savings. Here are some essential dos and don’ts:

Dos:

- Do keep detailed records of income and expenses throughout the year.

- Do estimate and pay quarterly taxes to avoid penalties.

- Do explore deductions and credits specific to self-employment.

Don’ts:

- Don’t overlook eligible deductions like home office expenses or mileage.

- Don’t ignore deadlines for estimated tax payments or tax filing.

- Don’t forget to review your tax return for accuracy before submission.

Insiders Tax Hack: Simplify Your Tax Filing

Make tax season easier with these insider tips:

- Use Tax Software: Simplify calculations and ensure accuracy with user-friendly tax software.

- Track Expenses Diligently: Keep detailed records to maximize deductions and minimize tax liability.

- Set Reminders: Stay organized by setting reminders for quarterly estimated tax payments and filing deadlines.

The Self-Employed Tax Credit (SETC): Your Best Self Employed Tax Solution

Discover the ultimate solution for maximizing tax benefits as a side hustler:

- Qualify for the SETC Based on Business Impact: Determine eligibility by assessing revenue declines or business interruptions, such as those experienced during the COVID-19 pandemic.

- Enhance Your Tax Strategy: Claim the SETC to directly reduce your tax liability, potentially resulting in higher refunds or lower tax payments.

- Maximize Financial Stability: Utilize the SETC to optimize your tax filing strategy and support your side hustle or freelance career effectively.

How to Unlock Potential SETC Savings from COVID-19

The COVID-19 pandemic impacted many side hustlers and freelancers. The IRS offered various tax relief measures to help. While this guide covers general deductions and credits, there might be additional benefits specific to COVID-19 that apply to your situation.

The IRS website (https://www.irs.gov/) provides a wealth of information on tax benefits related to COVID-19. You can also use their free online tools to see if you qualify for any unclaimed tax credits like the SETC.

Considering a Done For You SETC Solution

For a more personalized assessment of your tax situation, consider consulting a tax professional specializing in self-employment taxes. They can help you determine if you missed any COVID-19 tax benefits and ensure you’re taking advantage of all available deductions and credits.

This revised section emphasizes taking advantage of free resources from the IRS while acknowledging the potential benefit of consulting a tax professional. It avoids promoting unverified claims and potential scams.

Additional Information and Resources

For further assistance with your taxes and maximizing deductions, consider the following resources:

- IRS Website: Access forms, publications, and resources directly from the IRS website at www.irs.gov.

- Tax Software: Explore reputable tax software options like TurboTax, H&R Block, or TaxAct for simplified tax preparation.

- Professional Assistance: Consult with a tax professional or accountant specializing in small business or self-employment taxes for personalized guidance.

- Done For You Solution (Cost Free)Has Your Self Employed Side Hustle Business Been Hurt by Covid? Then Claim YOUR Money that is set aside and waiting for self-employed side hustlers just like you! Watch the video below to Unlock your Funds today and get paid in 14 days (no cost involved)! Click here to get started!

Conclusion: Empowering Side Hustlers Through Tax Knowledge

Mastering Form 1040 is a crucial step towards financial success in your side hustle or freelance career. By understanding how to navigate taxes effectively, you not only ensure compliance but also maximize your earnings through strategic deductions and credits. We’ve identified the Self-Employed Tax Credit (SETC) as the best solution for side hustlers, providing a quick and easy tax refund solution that is free of charge. Stay proactive in managing your finances and explore available resources to continue growing your business with confidence.